H1 Heading

View general elements of the style typography in the template, although please do visit the various pages in the demo to discover a fuller set of what is available.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vestibulum at sem ut ipsum vestibulum euismod. Mauris et massa porta leo facilisis feugiat. Suspendisse id neque a sem facilisis blandit. Aliquam sem leo, commodo ut, rutrum auctor, iaculis nec, eros.

button button-2 button button-3

H2 Heading

Nullam eget neque. Nullam imperdiet venenatis ligula. Integer a leo. Nunc consectetur. Maecenas sem. Proin vulputate, massa vel volutpat laoreet, purus erat pretium ligula, eget varius arcu nibh sed libero. Fusce ante. Nullam interdum aliquet metus. Ut ultrices vestibulum tellus. Praesent quis erat.

H3 Heading

In erat. Pellentesque erat. Mauris vehicula vestibulum justo. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Nulla pulvinar est. Integer urna. Pellentesque pulvinar dui a magna. Nulla facilisi.

<p class="alert alert-error"></p>

button button-red button button-3 button-red

Praesent id dolor non erat viverra volutpat. Fusce tellus libero, luctus adipiscing, tincidunt vel, egestas vitae, eros. Vestibulum mollis, est id rhoncus volutpat, dolor velit tincidunt neque, vitae pellentesque ante sem eu nisl.

Donec facilisis, magna eget elementum pellentesque, augue arcu aliquet eros, eget convallis mauris ante quis magna.

button button-grey button button-grey button-large

Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Aenean et libero. Nam aliquam. Quisque vitae tortor id neque dignissim laoreet.

H4 Heading

Mauris lobortis. Aliquam lacinia purus. Pellentesque magna. Mauris euismod metus nec tortor. Phasellus elementum, quam a <code></code> imperdiet, ligula felis faucibus enim, eu malesuada nunc felis sed turpis. Morbi convallis luctus tortor. Integer bibendum lacinia velit. Suspendisse mi lorem, porttitor ut, interdum et, lobortis a, lectus.

<p class="alert alert-success"></p>

Duis eu ante. Integer at sapien. Praesent sed nisl tempor est pulvinar tristique. Maecenas non lorem quis mi laoreet adipiscing.

<blockquote> <p><cite title=""></cite></small> </blockquote>

Someone famous Source Title

H5 Heading

Vestibulum mollis, est id rhoncus volutpat, dolor velit tincidunt neque, vitae pellentesque ante sem eu nisl. Donec facilisis, magna eget elementum pellentesque.

<p class="alert alert-info"></p>

button button-blue button button-blue button-xlarge

Donec facilisis, magna eget elementum pellentesque, augue arcu aliquet eros, eget convallis mauris ante quis magna.

<p>Sample text here…</p>

button button-grey button-small button button-grey button-xsmall

H6 Heading

Nam id turpis sit amet neque cursus luctus. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Quisque id tortor. In vitae sapien. Nunc quis tellus.

<p class="alert alert-warning"></p>

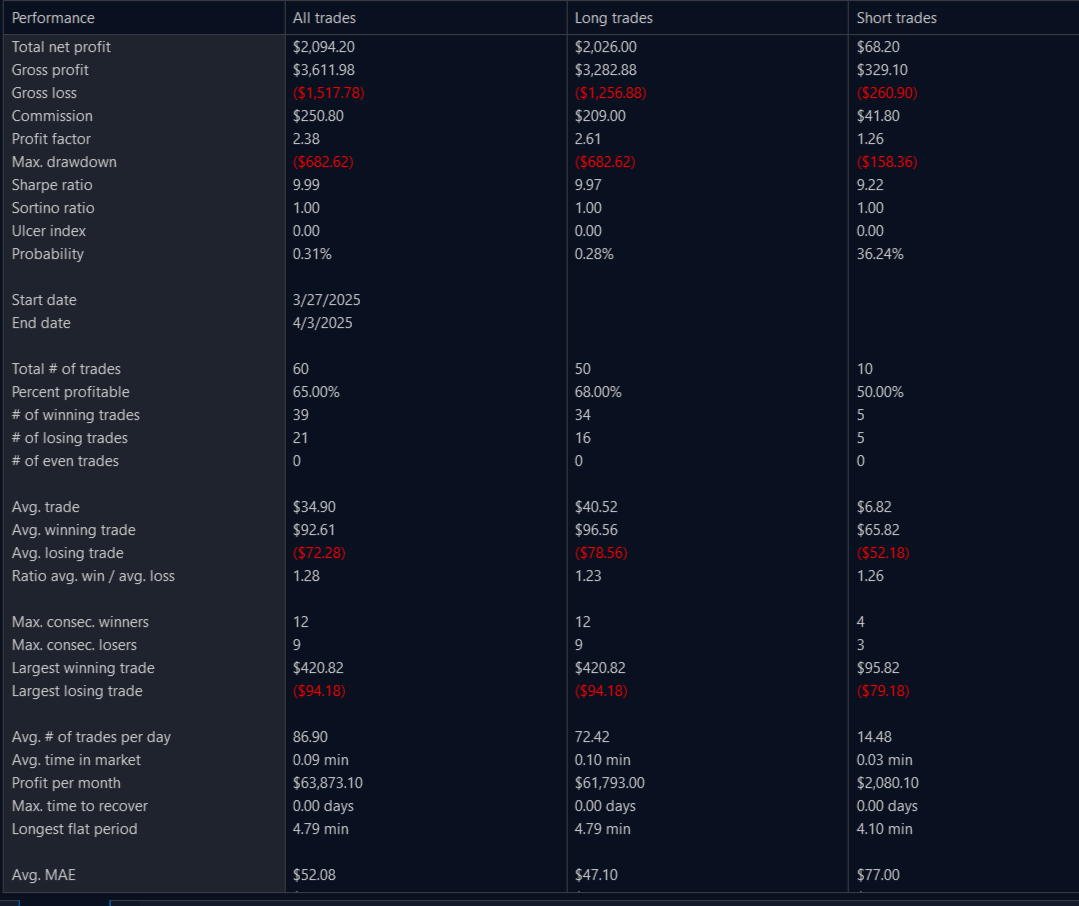

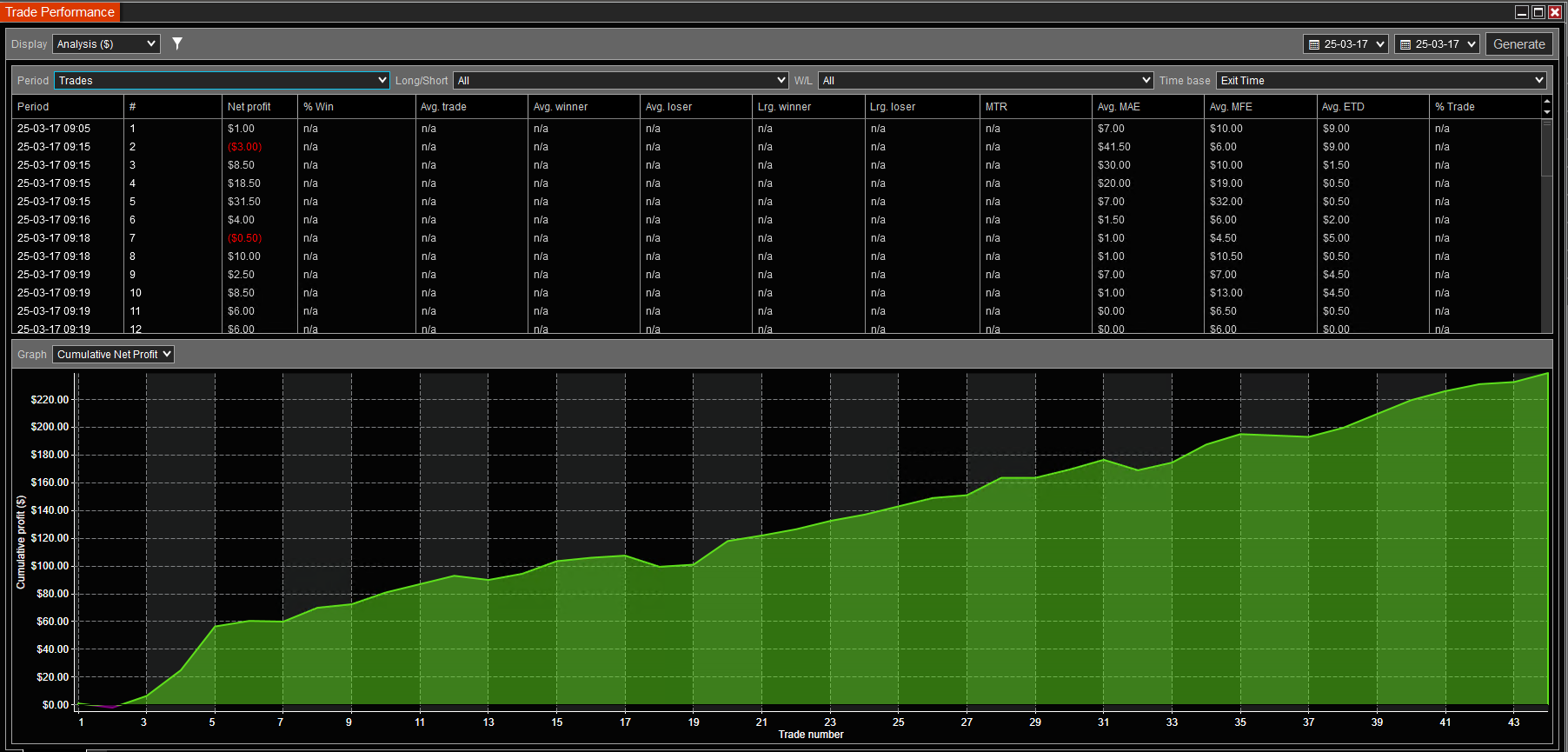

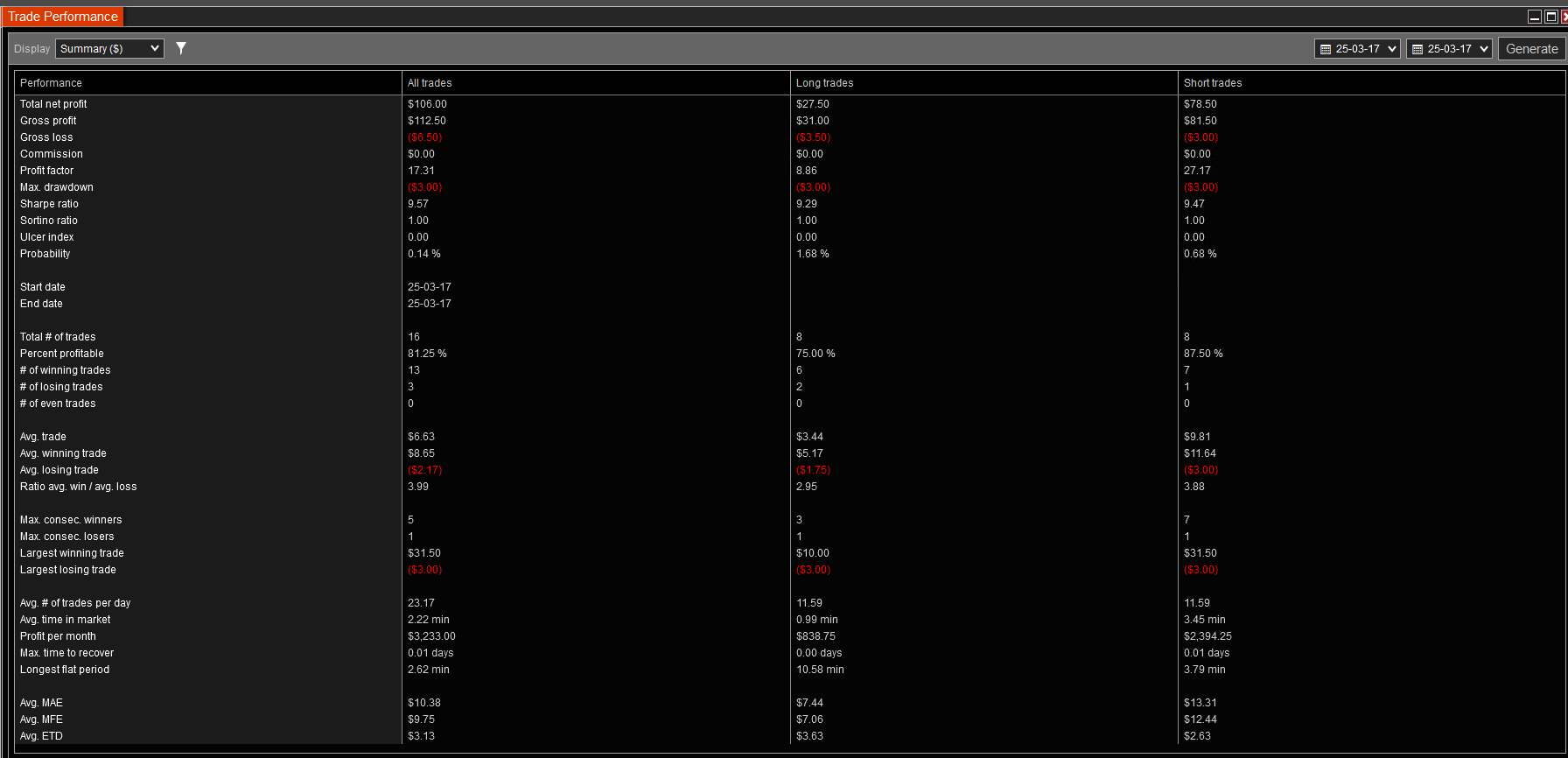

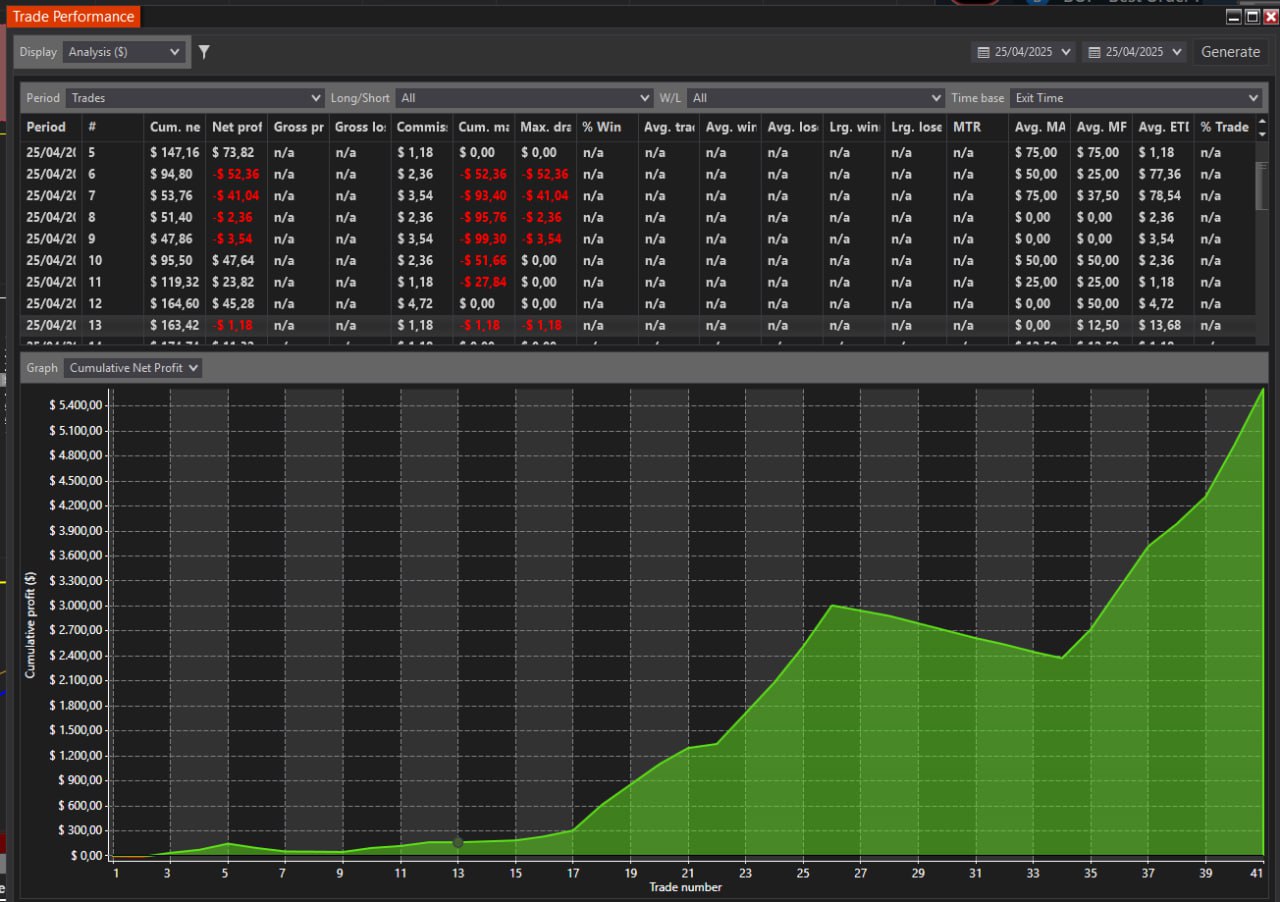

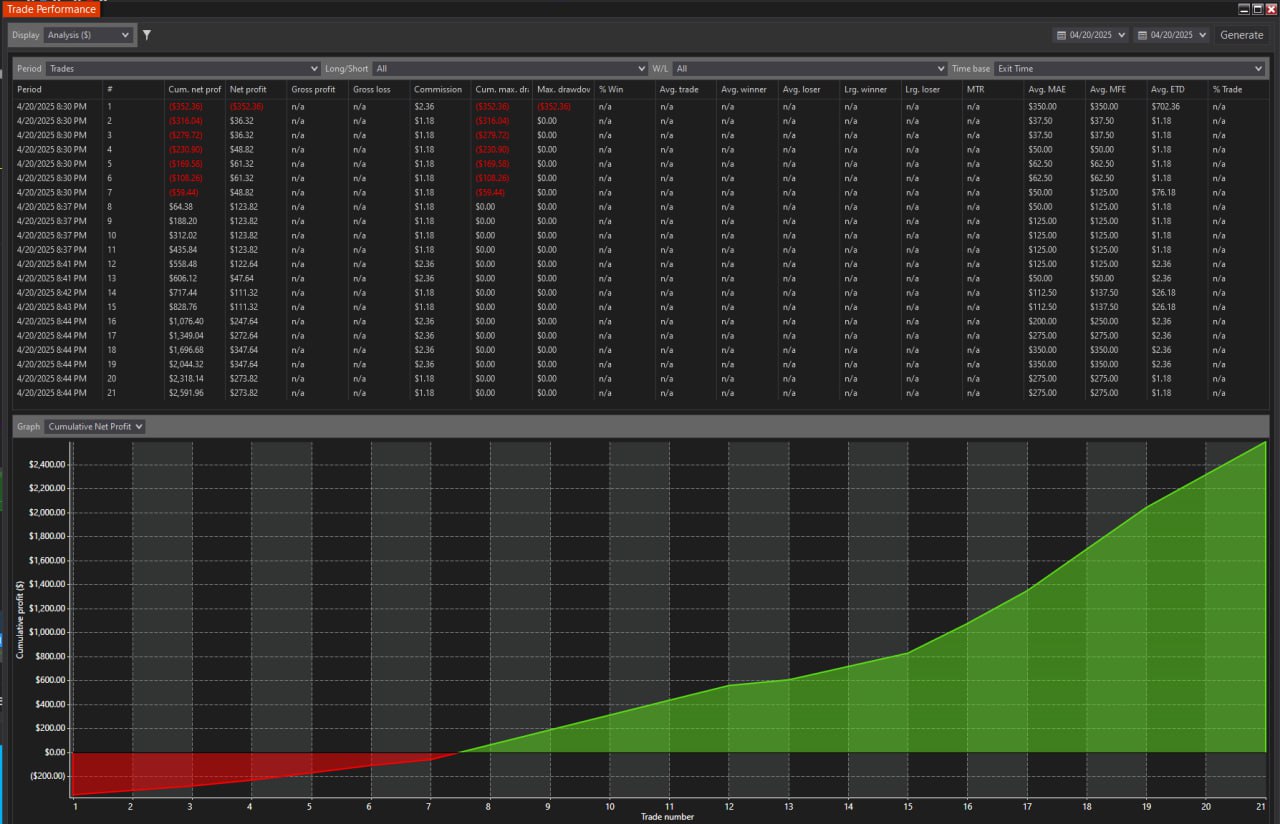

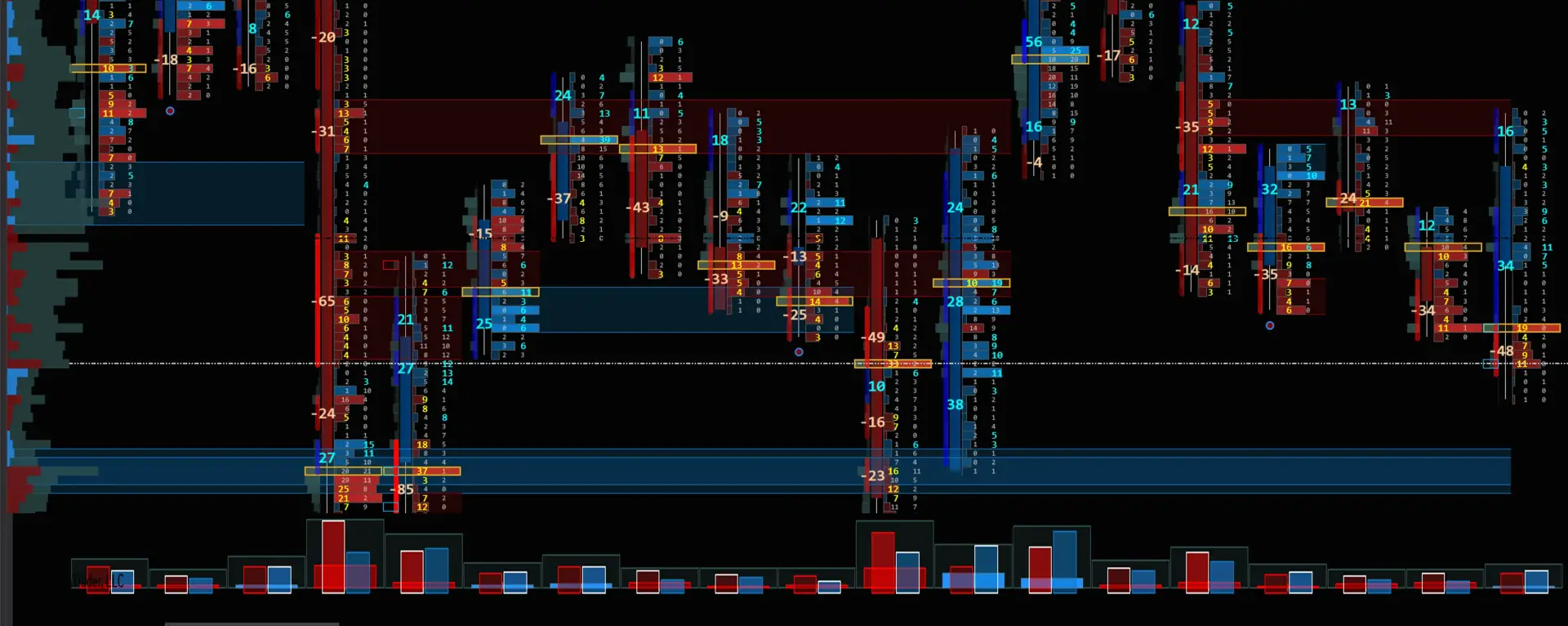

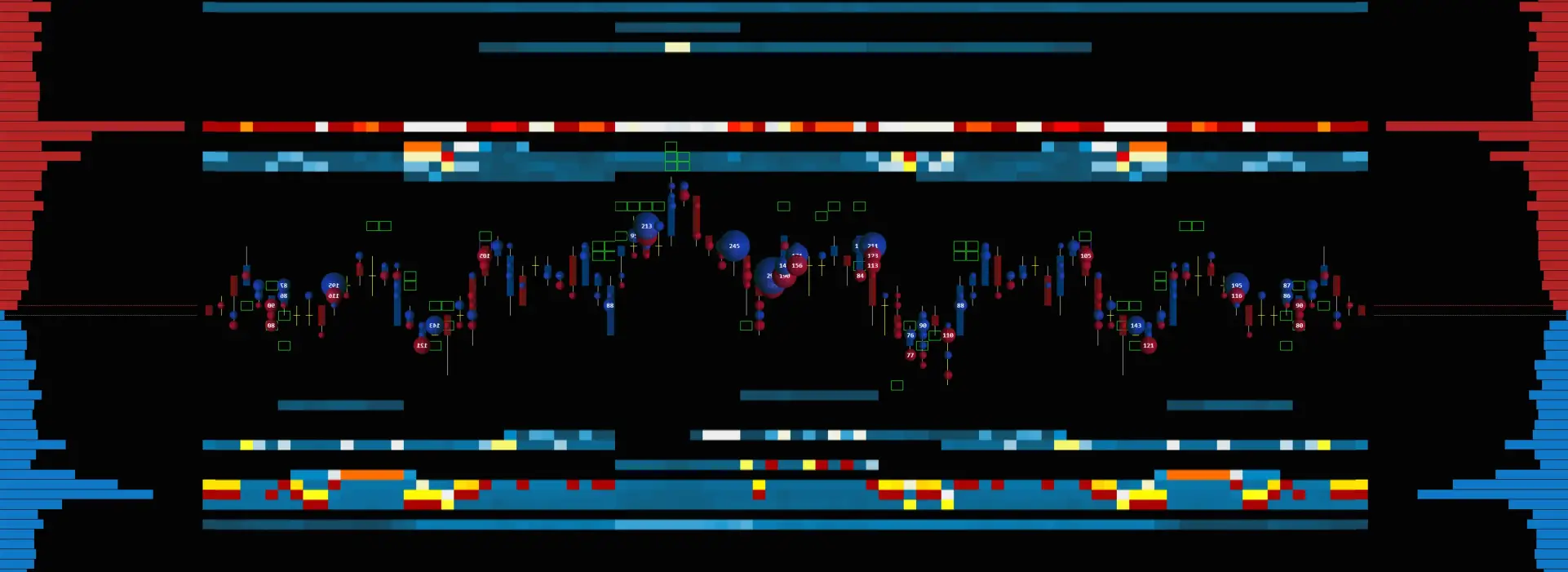

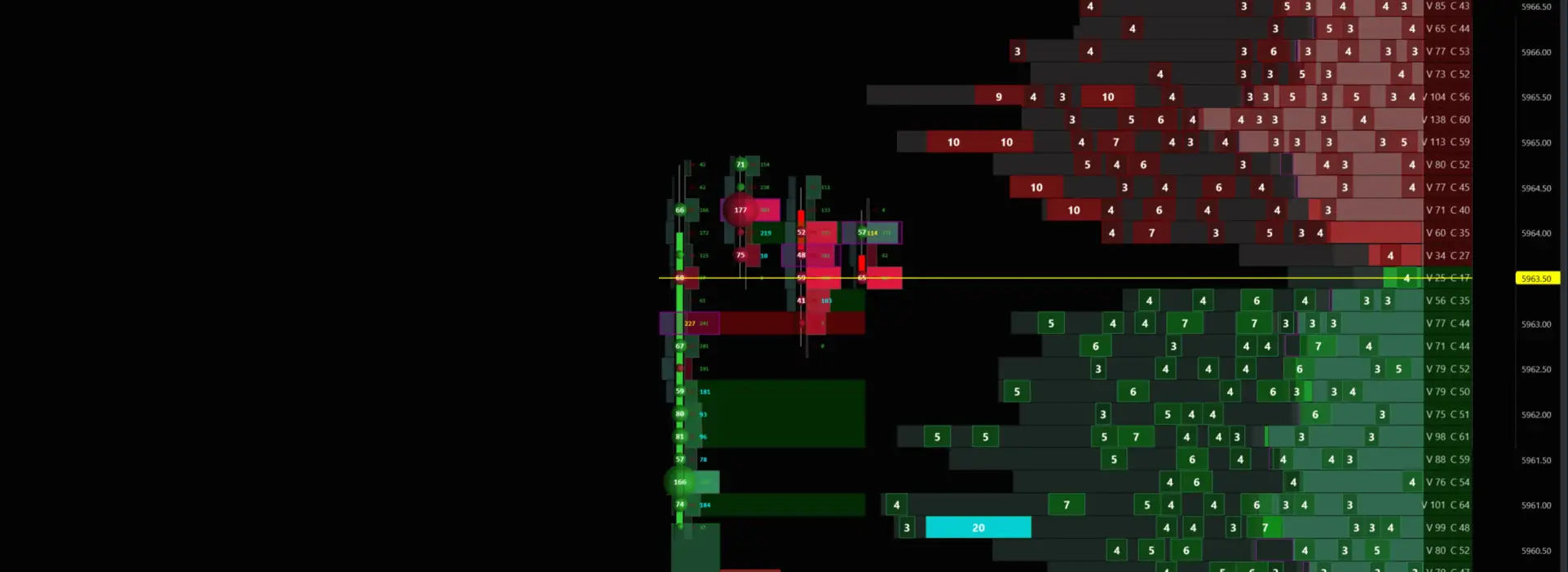

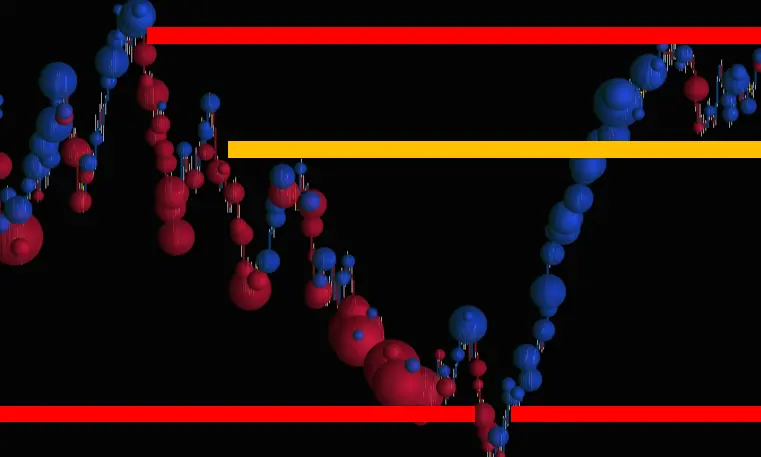

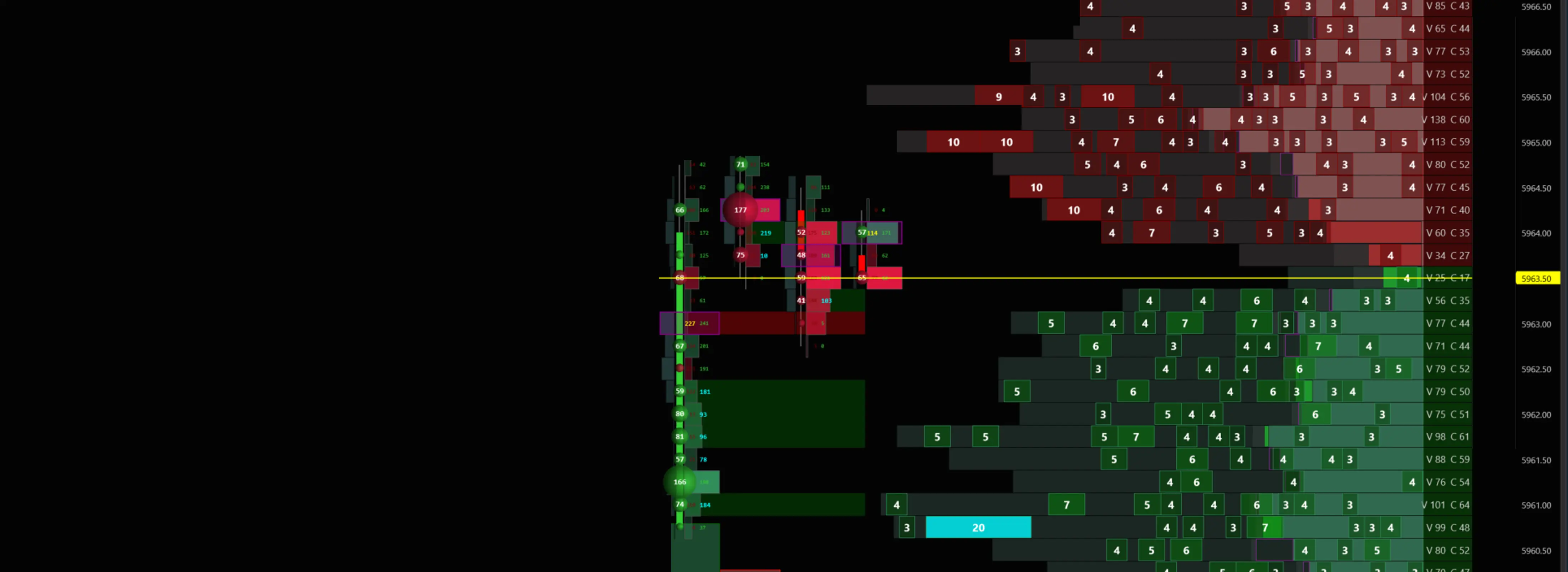

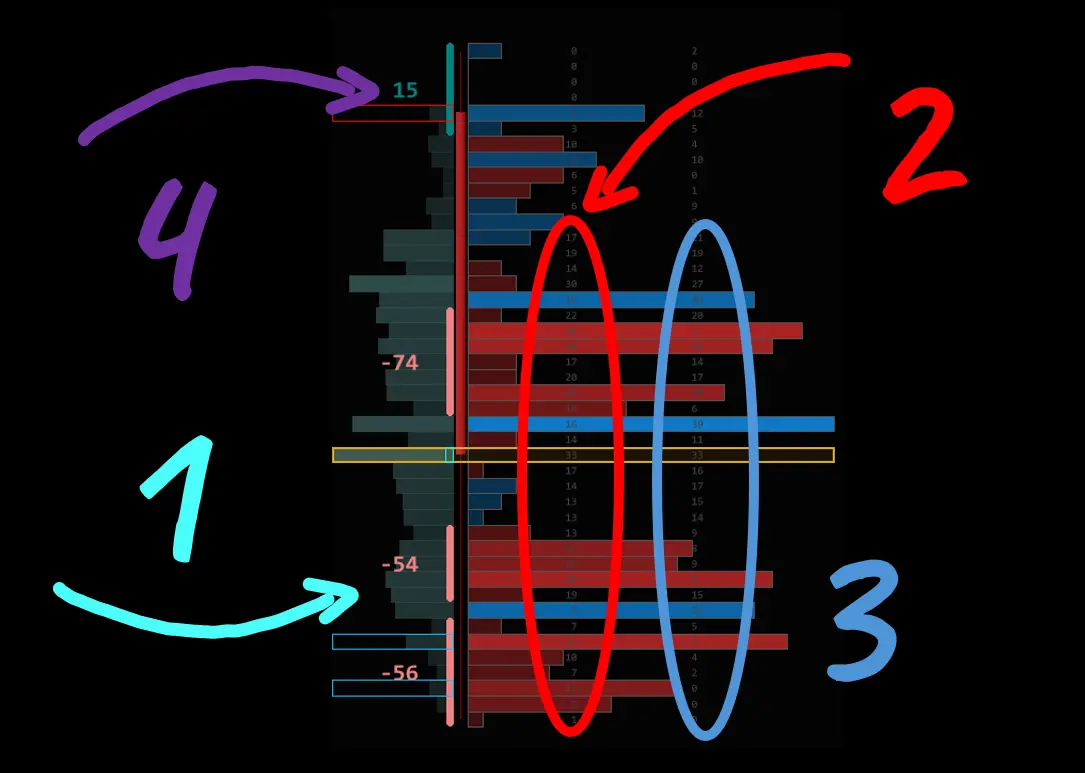

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.