PACK 1 - LIST OF AGGRESSIVE VOLUME INDICATORS

- Footprint

- Bid/ Ask,

- Stack imbalances,

- Filtered imbalances,

- Clusters,

- Absorption,

- Diversions, Delta blocks,

- Delta Profile

- Footer

- Volume

- Market Speed indicator (speed of tape)

- Utilities

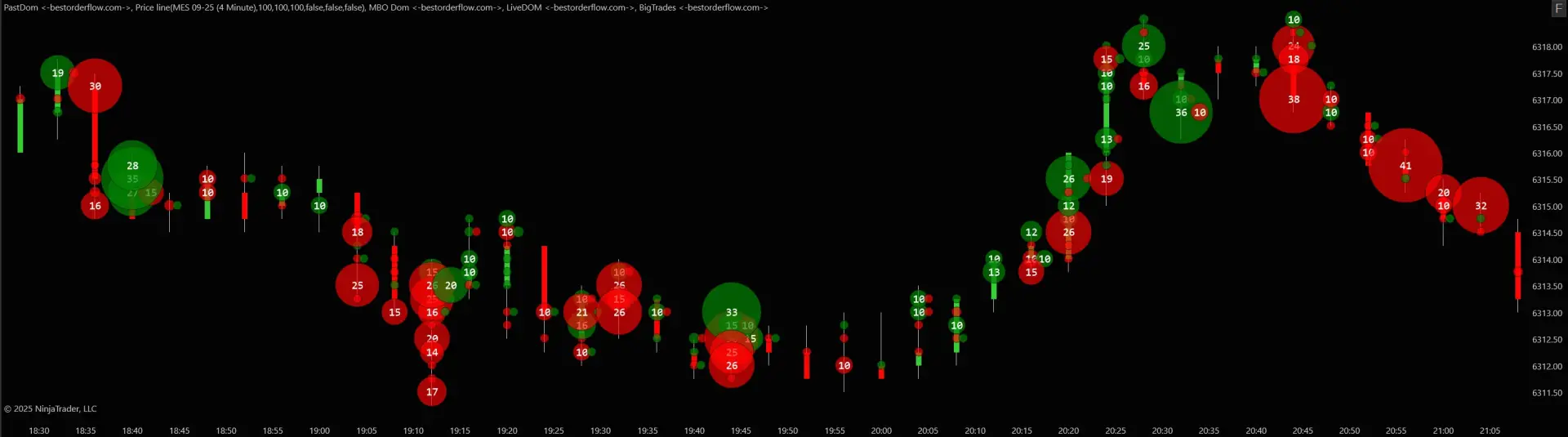

- Trades visualization indicator,

- Scroll advanced

- Volume profile is a horizontal histogram that displays the volume spread across vertical price levels. It shows traders where the most activity occurs at specific price points. The volume profile provides insights into market liquidity and potential support and resistance levels. Link

FOOTPRINT DEFINITION:

What Is a Footprint Indicator in Trading?

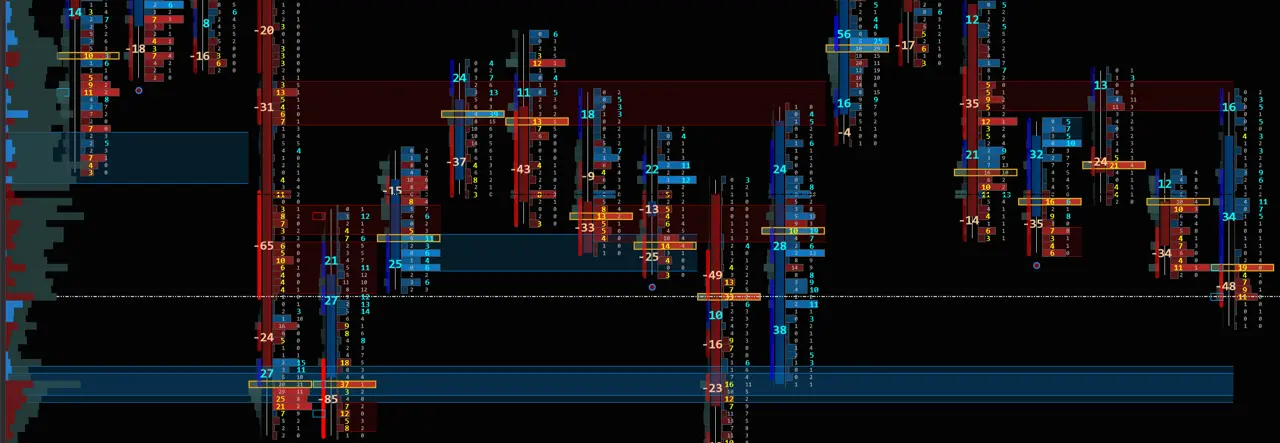

Footprint is an Aggressive volume indicator that displays orders executed by Market participants on the Aggressive side of Order Flow.

Footprint records buying and selling activities at each price level. Each order print is its size in volume, and the number of orders in a lot. In simple terms, a Footprint is a visual display of an asset's accumulations and distributions.

Footprint data is presented in various formats. Based on footprint data, we can interpret the exhaustion of buyers or sellers, a change in trend, absorption by buyers or sellers, imbalance, clusters, and cluster zones that become support and resistance.

The data used is level 1 data. Footprint displays aggressive order activities because the orders executed on the footprint are entered out of desperation, with a slight instant loss.

The orders of aggressive participants interact only with passive limit orders waiting on the other side of the order flow.

Notice: Aggressive buy orders by the market do not result in purchases from market sellers.

And aggressive sellers by market never sell to aggressive buyers by market.

A new type of Footprint presents complex data in an easy-to-visualize format.

FOOTPRINT OLD SCHOOL VERSUS NEW SCHOOL

The old-school Footprint chart resembles an Excel table with candlesticks.  The old school footprint looks like Excel.The old school of a Footprint requires a lot of mental energy to process and analyze the order flow and the activities of buyers and sellers.

The old school footprint looks like Excel.The old school of a Footprint requires a lot of mental energy to process and analyze the order flow and the activities of buyers and sellers.

The new type of Footprint presents complex data in a simple visual way, allowing traders to make analyses quickly and easily, without complications. The Footprint from BestOrderFlow is a new generation, a new school of data presented in an easy-to-read format, to facilitate trading decisions for traders.

PURPOSE TO USE FOOTPRINT CHARTS:

- Footprint provides a deeper X-ray view inside a candle bar.

- Footprint provided better insight into market dynamics compared to traditional candlestick charts and price action analysis, such as Smart Money Price Action.

- Footprint provided help to traders in understanding the real reasons behind price movements, based on solid data, rather than relying on guesswork.

- The footprint chart is utilized by day traders, swing traders, and scalpers in intraday trading.

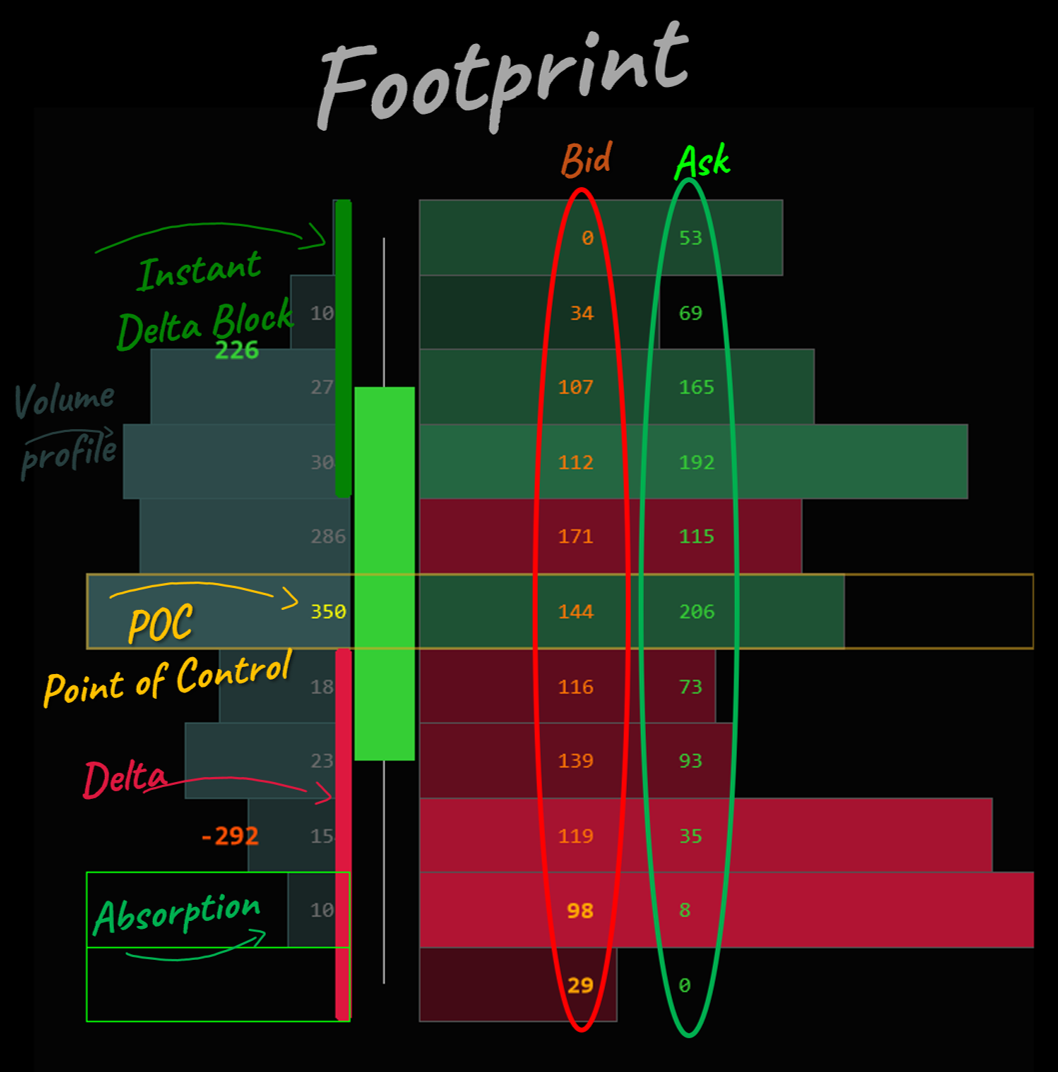

BASIC ELEMENTS OF A FOOTPRINT:

Footprint presents Level I data orders and includes volume and size of the orders at each price:

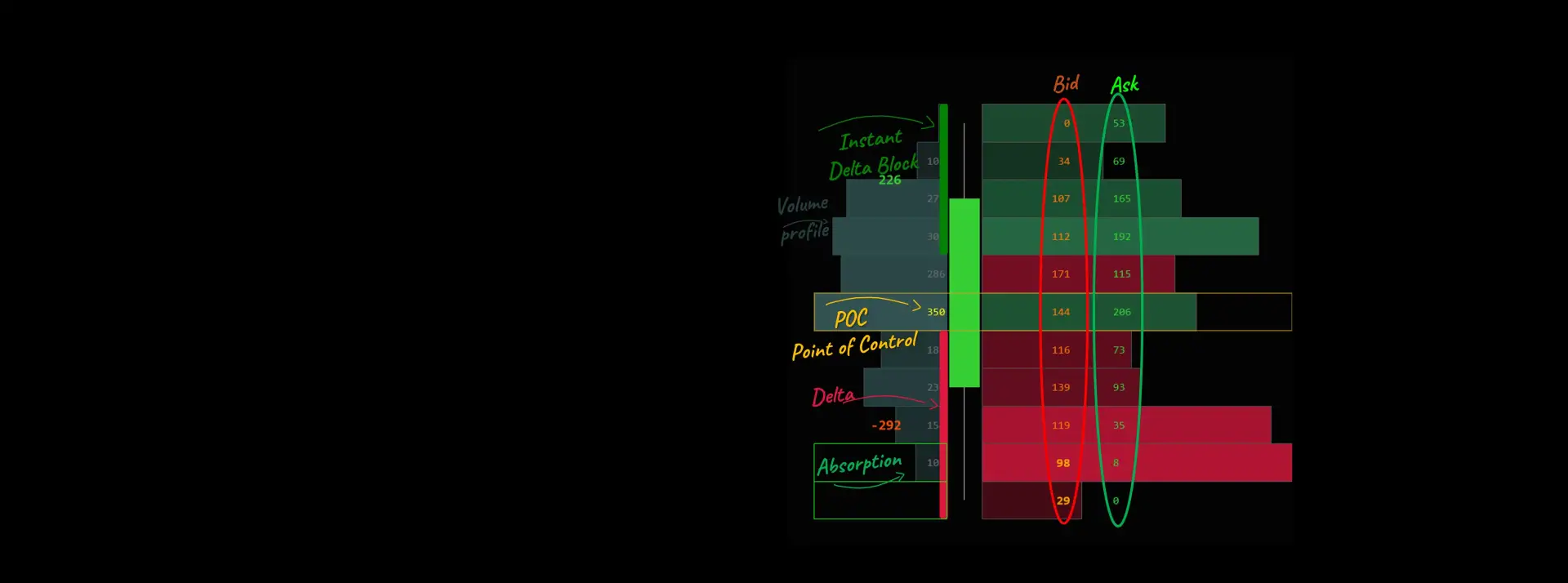

Best Bid and Ask Prices:

The highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

Bid and Ask Sizes:

The number of shares, forex lots, or contracts available at the bid and ask prices.

Last Trade Price and Size:

The price and number of shares, forex lots, or contracts involved in the most recent transaction.

Volume:

The total number of shares, forex lots, or contracts traded during the current period.

POC:

Price with the highest volume traded in a candle bar is POC - Point of Control (colored in yellow)

ABSORPTION DEFINITION: Absorption showed an aggressive side on level 1 sellers or buyers were absorbed by level 2 passive (limit) orders in the opposite direction. Absorption, or repeated absorption, is a precursor to trend reversals and an indicator of support and resistance zones.

In this screenshot, the footprint can reveal price absorption areas to the left of the candlebar, marked by bright rectangles. (usually at the top or bottom with a red or green outlined rectangle).

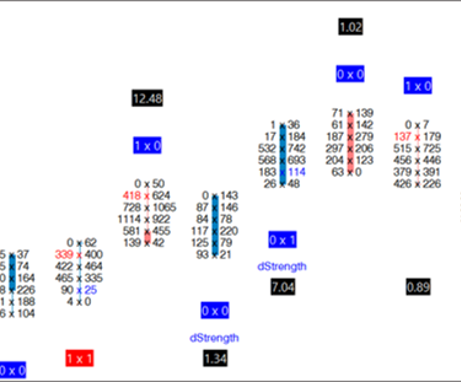

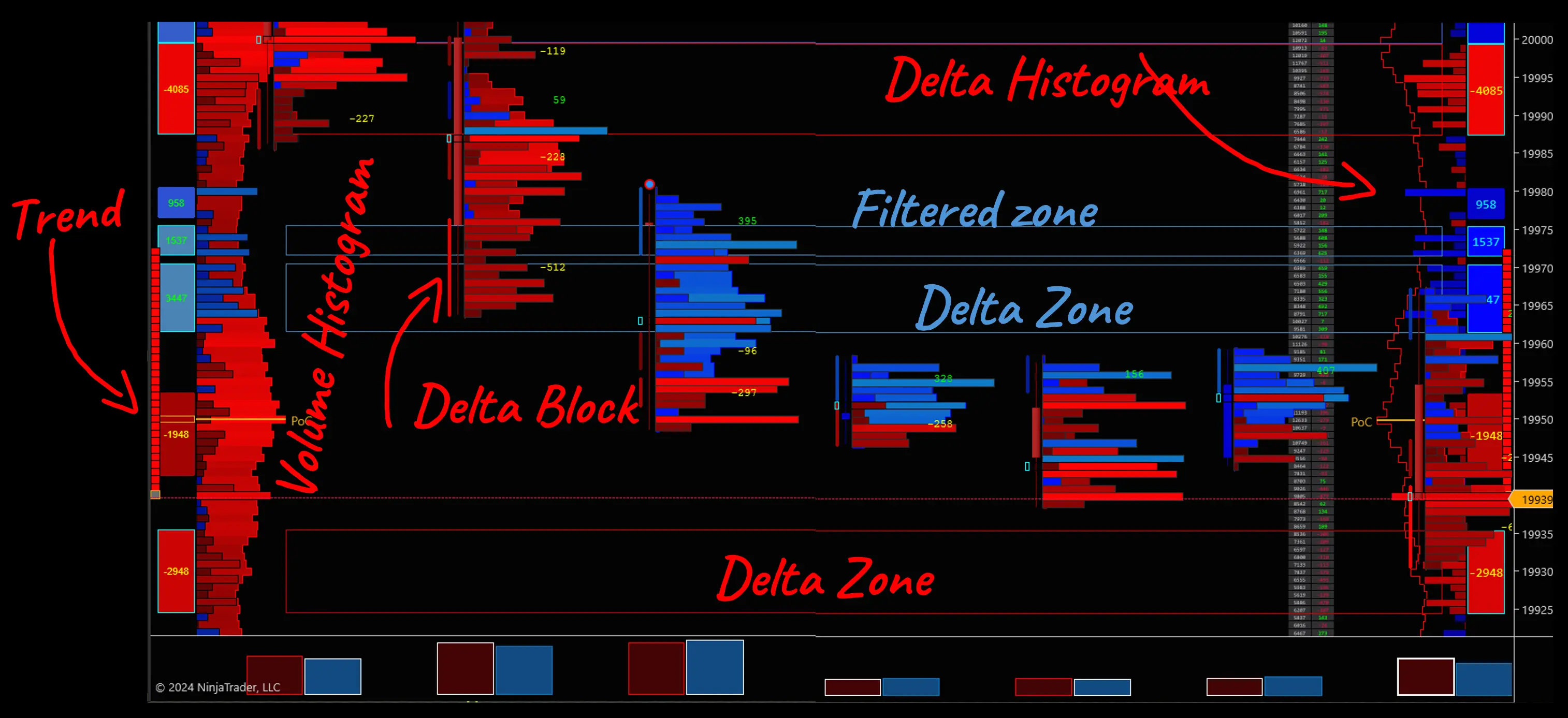

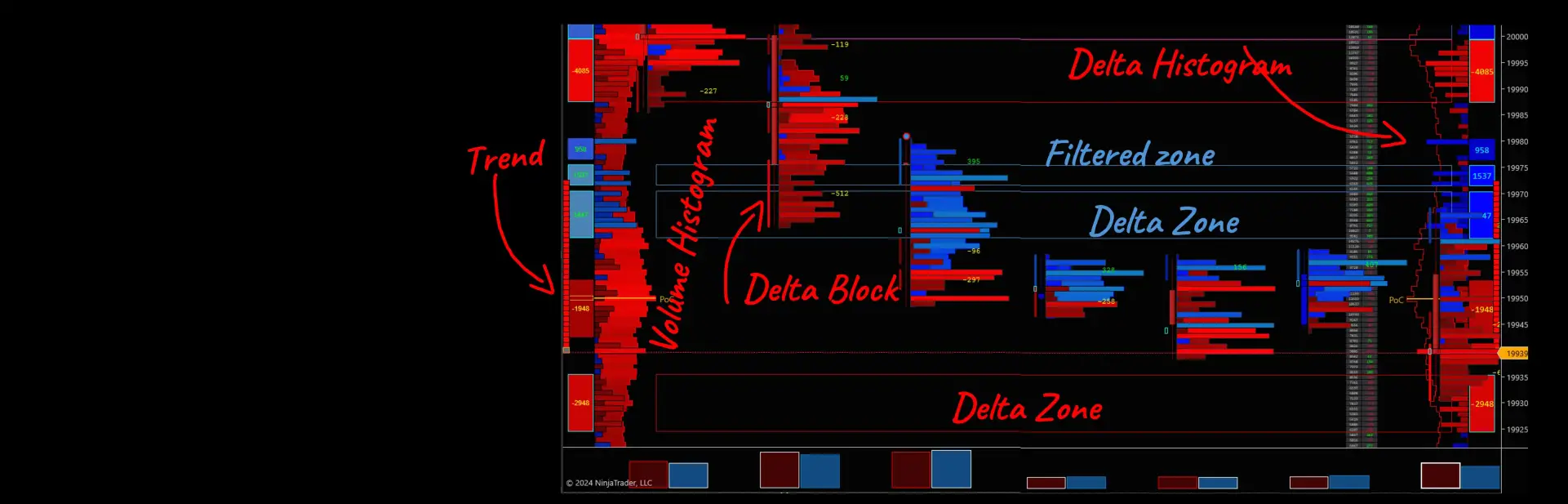

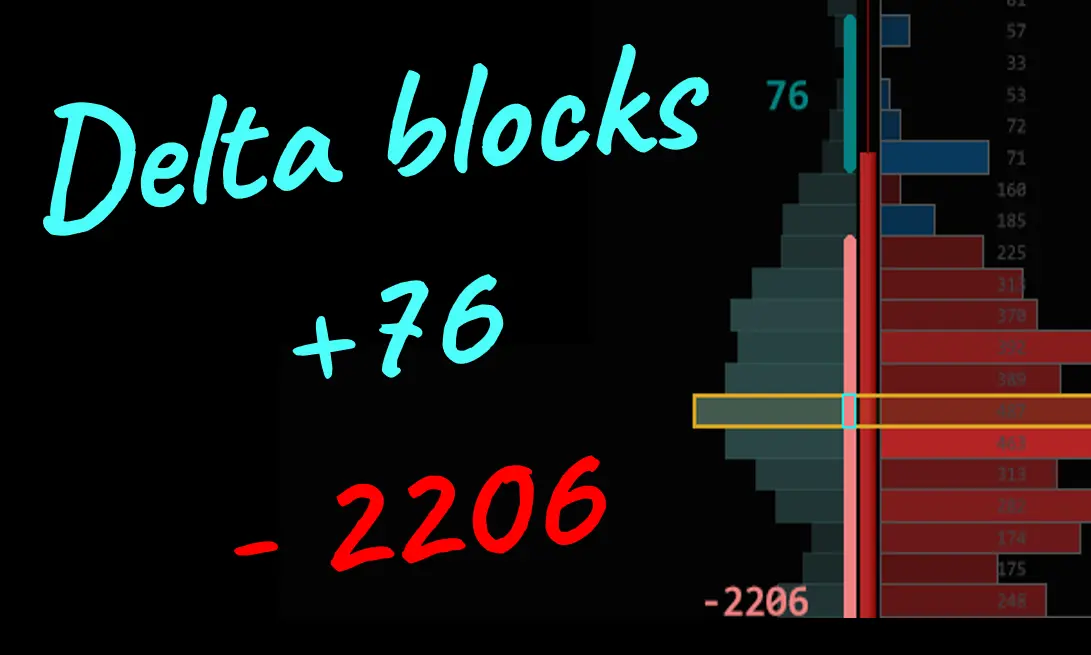

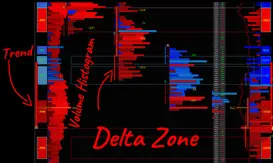

Delta and Delta Block - the New way to display Delta

The Difference between the ask and bid volume on a footprint is a delta. Delta indicates whether buyers or sellers are more aggressive and more likely to win at that price level. Deltac Block is a real-time delta shown alongside a developing candle bar.

Delta Blocks directly on the Footprint:

The new easiest way to view Delta is on a footprint chart. Not on the footer as many others do.

Using the same calculations of ask minus bid volume, we can create a footprint chart that not only shows the delta amount but also allows us to visualize where and when that delta volume was transacted.

In this screenshot, Delta Block is represented by a slim green or red rectangle to the left of the candle bar, with a volume number of 226, which indicates the buyers' delta, and 292 represents the sellers' delta. Delta bars indicate an instantaneous change in delta during candle bar development.

Notice left of a candle bar is an additional rectangle block (green or red, semi-transparent) that is shorter than the candle bar. This is the Delta block left of the candle bar.

The old-school footprint position total delta, which is displayed above or below the candle, or shown in the footer (below the chart) after the bar closes. That is the old-school way to display delta.

To see the old-school Delta, you have to wait until the bar closes. That is not convenient and takes extra mental power to search for the delta information and wait for the bar to close. The footer summary for Total Delta is lacking the price at which that delta accumulates. Now you know exactly the price level at which positive or negative delta accumulated.

Best OrderFlow displays the total delta on the footer, as well as the delta inside the candle as it grows.

The delta bar along the candle indicates additional information: the price levels at which a significant delta builds up.

The delta bars are calculated in real-time, unlike most other old-school footprints, which are calculated at the close of the bar. Based on the Delta Blocks, we can get delta zones for support and resistance.

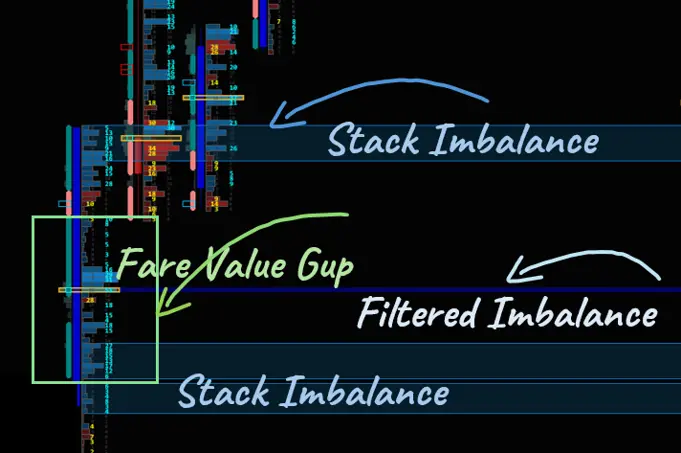

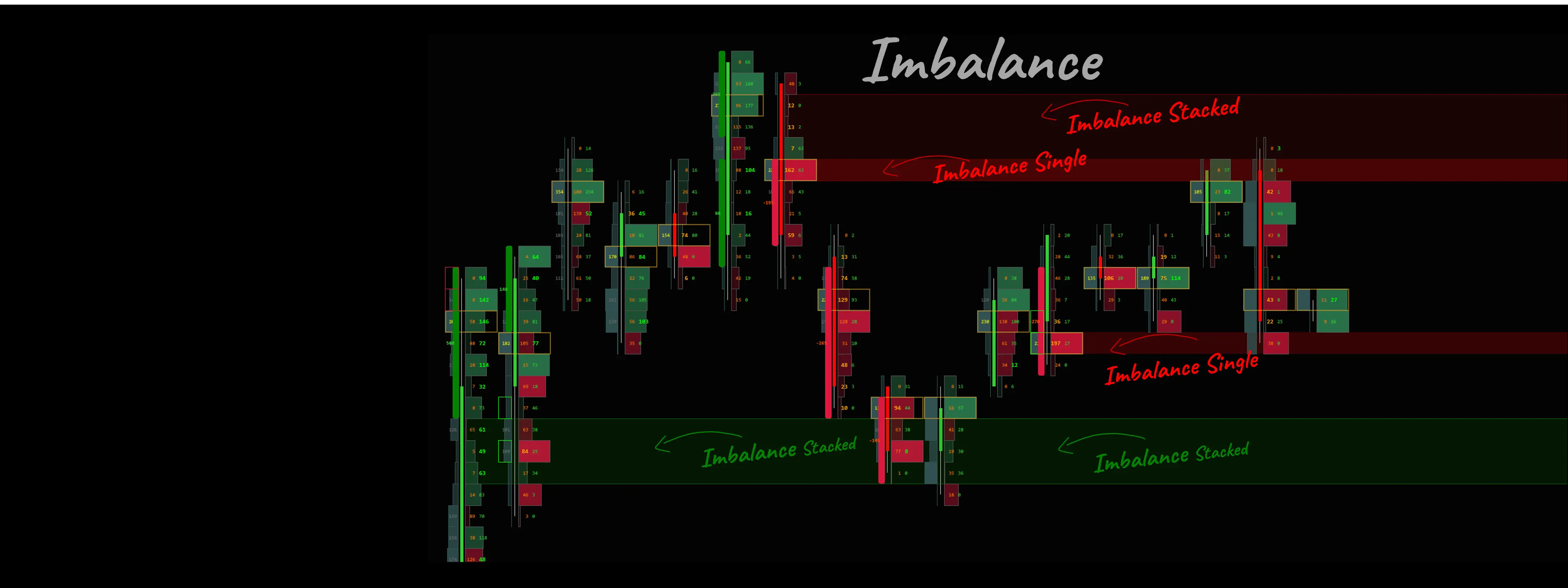

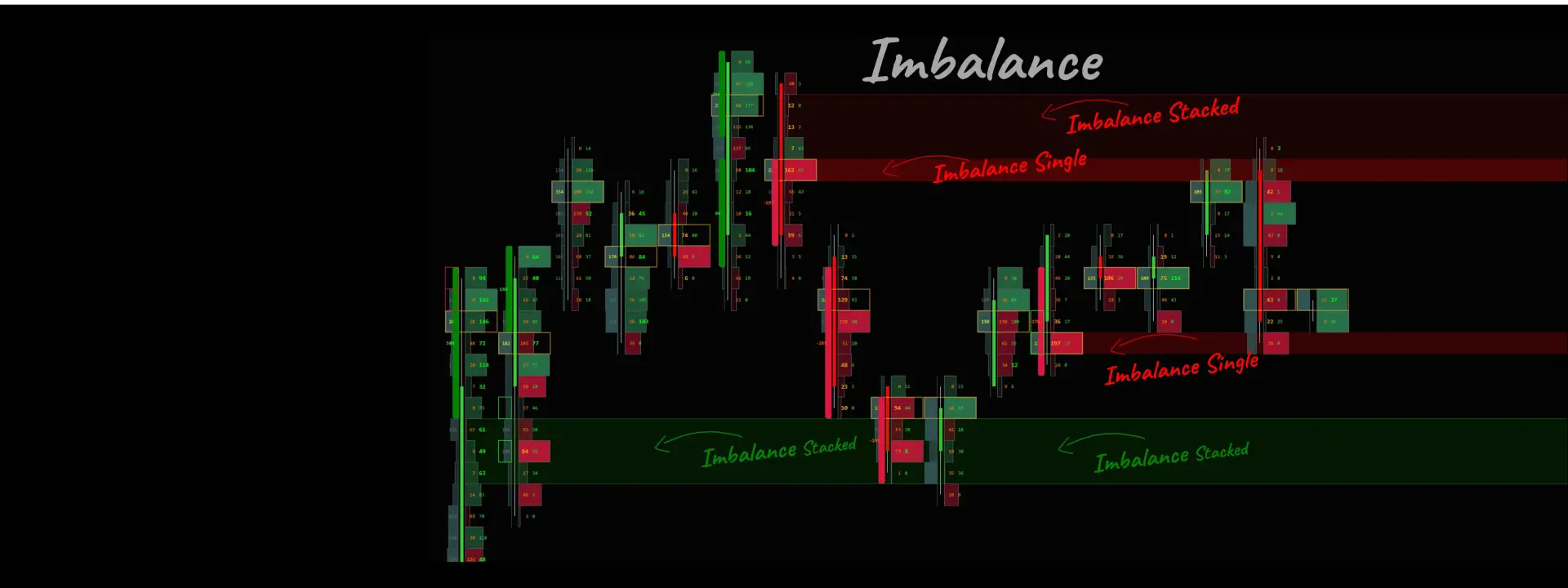

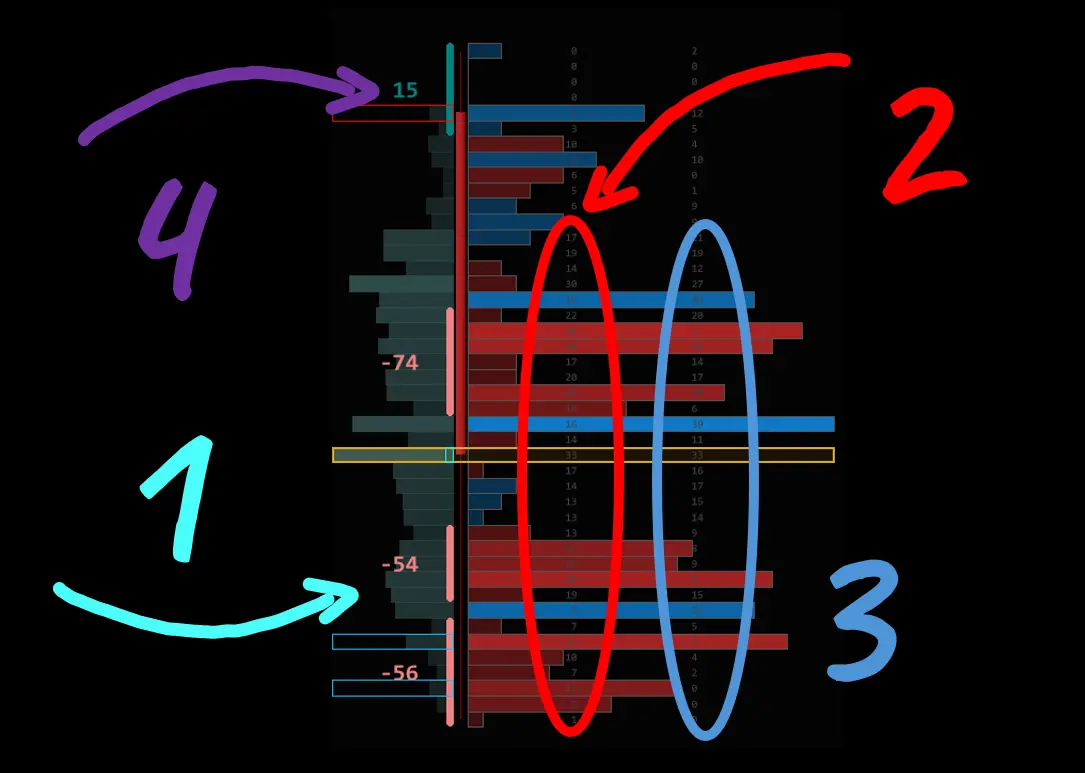

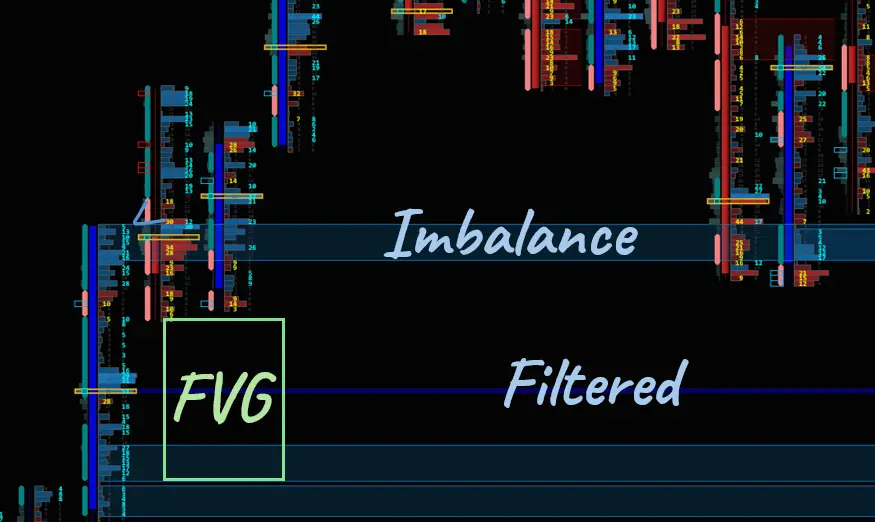

IMBALANCE: Tree Type of Imbalance:

IMBALANCE: Tree Type of Imbalance:

- Single filtered imbalance,

- Stack Imbalance,

- FVG - Fare Value Gap imbalance

WHAT IS IMBALANCE: An imbalance between orders occurs when orders on one side are significantly more prevalent than those on the other side, and the price extends without resistance, creating an impulse move. The footprint imbalance can display simple and stacked calculated imbalances.

FVG IMBALANCE: Fare Value Gap FVG imbalance is a type of imbalance that is easy to spot and used in a smart money concept/price action trading. Smart Money Traders can significantly advance their trading with a footprint imbalance.

A SINGLE FILTERED IMBALANCE is used for straddle price reaction, pullback, and reversal strategies. It was developed at the special request of one of our influential traders. Prices tend to respect single imbalances a lot.

STACK IMBALANCE: An imbalance in the market occurs when there is a significant difference between buy orders at the Ask and sell orders at the Bid. The imbalance is shown when the bid and ask exceed a specific ratio (210%-230%). A stacked imbalance happens when multiple imbalances occur consecutively across price levels, signaling either aggressive buying or selling.

FOOTPRINT STYLE: DELTA

Delta Zone + Delta Profile + Delta Block+Delta Trend

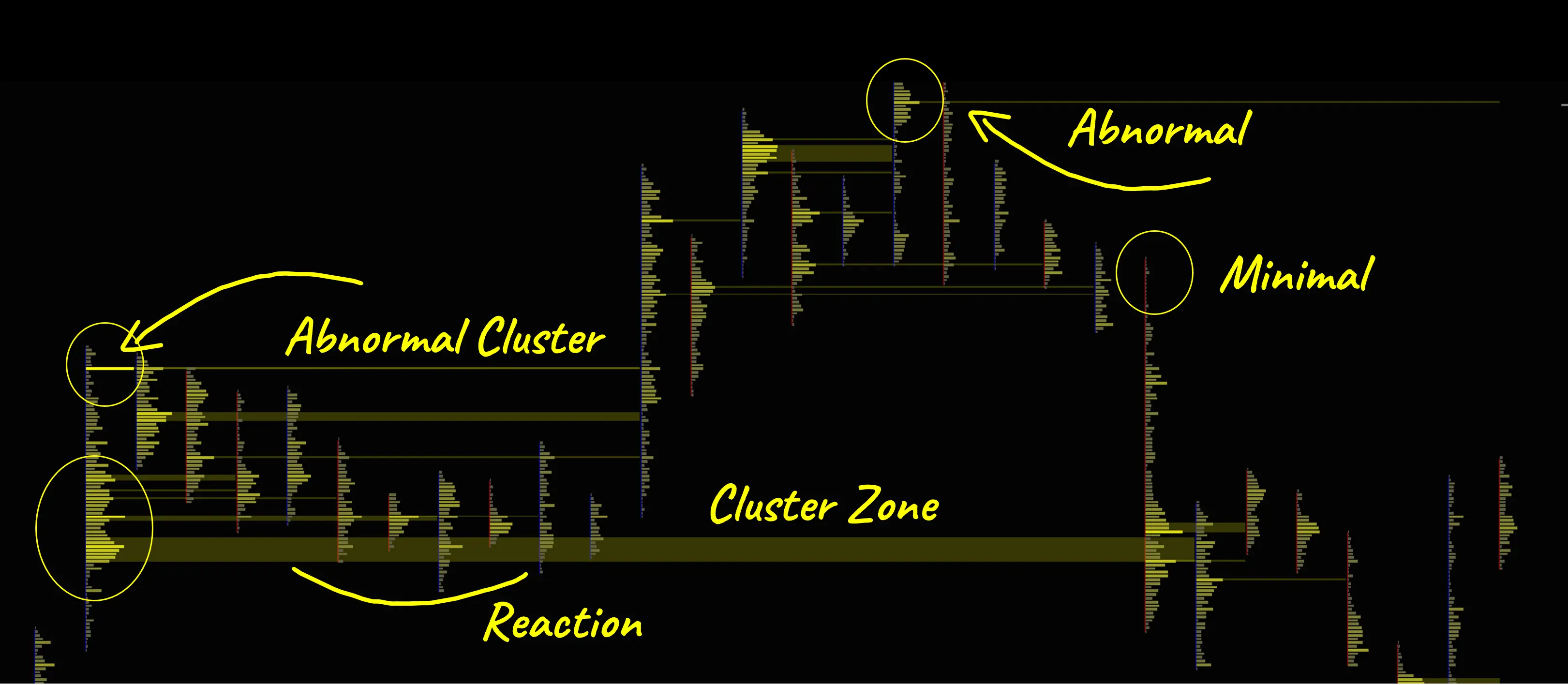

FOOTPRINT STYLE: CLUSTERS:

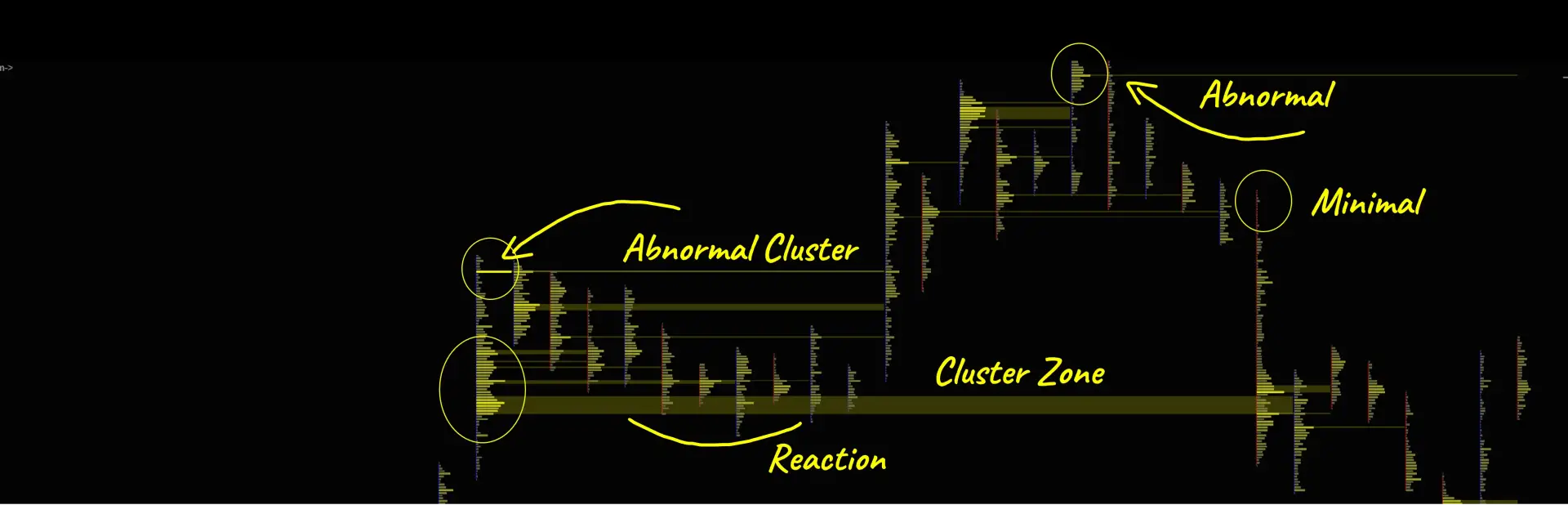

Footprint is a great indicator for clusters. Cluster patterns can be traded with high precision and a high win rate.

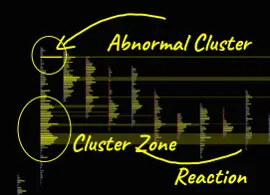

Cluster is a significant volume traded on the footprint. It indicates high trading activity at specific price levels. An unusually high volume characterizes an abnormal cluster compared to the average trades above and below. Clusters are areas of interest and respected by price as support and resistance zones, areas for retest. The clusters trading system is a popular way to trade footprint and volume profile.

- Large clusters are often used for positioning stop losses and take profits.

- Minimal clusters are a great indication of trend exhaustion and a good entry point for a trade.

The footprint indicator can be set to make a cluster style as shown in the image below. You are welcome to use our ready-to-use template for a cluster style.

THREE MAIN REASONS TO USE BOF FOOTPRINT

Would you know why professionals dump old school footprints and use BOF Footprint instead?

1) Speed and Automation

BOF Footprint is the fastest ever footprint for manual trading and trading with automation, algo, and bots. All and every other footprint out there is lagging behind BOF Footprint. Any automation developed on a lagging Footprint suffers from stealing profits on every single trade. Any automation developed on a lagging Footprint is defective by default. Every millisecond delay in automation can make or break your strategy and your bank account. The more other indicators on a chart besides Footprint, the less likely a chart is to execute in real time.

Measure:

Test. Test and Test. Test it yourself to verify the actual data and make an informed decision.

Test your favorite footprint running with a heatmap from any source, including paid NinjaTrader, on the same chart. Measure the delay/ lag on that chart performance during the NY open, high volatility, and high ATR.

Measure with any utility or with our Deposit Killer. Deposit Killer can measure chart performance in real time. Conduct a few tests on your own so you don't have to rely solely on our conclusions. In multiple tests for Footprint and Heatmap, we found that BOF - BestOrderFlow is the champion for utilizing a Footprint with multiple other indicators and a Heatmap NT on the same chart.

2) Footprint integrated with Heatmap

BOF Footprint is integrated and runs smoothly on Heatmap and MBO. We do not guarantee the performance of other footprints on our Heatmap NT and MBO indicators. Manual or automated trading is conducted at the highest speed possible, utilizing indicators Level 1, Level 2, and Level 3 on the same chart.

3) Footprint integrated with MBO Dom Market By Order

ONE-SIDED OR COMPLETE ORDERFLOW?

Would you prefer to trade only the Aggressive side on Level 1, the Passive side on Level 2 and 3, or a Complete Orderflow?

Now you can make more informed decisions than before:

Now you can work with all indicators using Data Level 1, Data Level 2, and Data Level 3 on the same chart. Now you can utilize both sides of order flow and market participation—the aggressive and passive sides of the market.

FOOTPRINT STRATEGIES:

Strategies based on Footprint:

- Imbalance, Stack Imbalance, Single Imbalance, Support and Resistance zone, Delta Diversion, Cluster patterns, Delta zone, Pig Tail Trend Momentum, Pullback, Front running, Absorption, Trend reversal, Order block, Fare Value Gaps. Delta Volume Profile, Delta Blocks. Trend exhaustion, Braketrogh, False brake.

Examples of strategies from our playlist and videos are provided below.

To fully utilize Footprint capabilities, please download the manuals and watch the educational videos provided below.

Footprint Explainer Videos + PDF MANUALS + INSTRUCTIONS:

Manuals / Instructions /

- Footprints elements and settings manual: Download PDF Footprint User Manual

- Download the PDF instructions for the Imbalance zone and the stack imbalance

- Download the Cluster Template for footprint

- Download PDF Volume Range Profile instructions

- Download the Absorption Indicator PDF User Manual

- Download Trades Visualisation indicator PDF Manual

- Download Market Speed - Speed of Tape PDF Manual

- Download Footer PDF Manual

Video instructions for Footprint:

How to set up Footprint settings and preferences

Video explainer:

How to set up stocked and single Imbalances on Footprint

Footprint for Clusters

1) Explainer video about Cluster Style:

Range Volume Profile and Delta Profile

Explainer video about Range Profile:

Delta Diversions

Explainer video for Delta Diversion:

Footprint Absorption Indicator

Explainer video about Absorption video

Trades: trades visualisation indicator video

Footer:

Market Speed of tape indicator video

LINKS FOR PACK 1 INDICATORS

(links open in a new window) :

- Footprint indicator for NinjaTrader : Bid/ Ask, Stack imbalances, Filtered imbalances, Clusters, Absorption, Diversions, Delta blocks, Delta visualization,

- Volume and Delta profile indicator for NinjaTrader is a horizontal histogram that displays the volume spread across vertical price levels. It shows traders where the most activity occurs at specific price points. The volume profile provides insights into market liquidity and potential support and resistance levels.

- Delta Footprint Style for NinjaTrader

- Footer indicators for NinjaTrader: Volume indicator, indicator for Delta bid, and Ask,

- Market Speed indicator (speed of tape) for NinjaTrader for NinjaTrader,

- Absorption indicator on the Footprint indicator for NinjaTrader.

- Utilities for NinjaTrader (click to learn more): Trade visualization indicator, Chart Scroll advanced

- Templates for Pack 1 Indicators - Chart Templates and Indicator templates for the NinjaTrader platform included

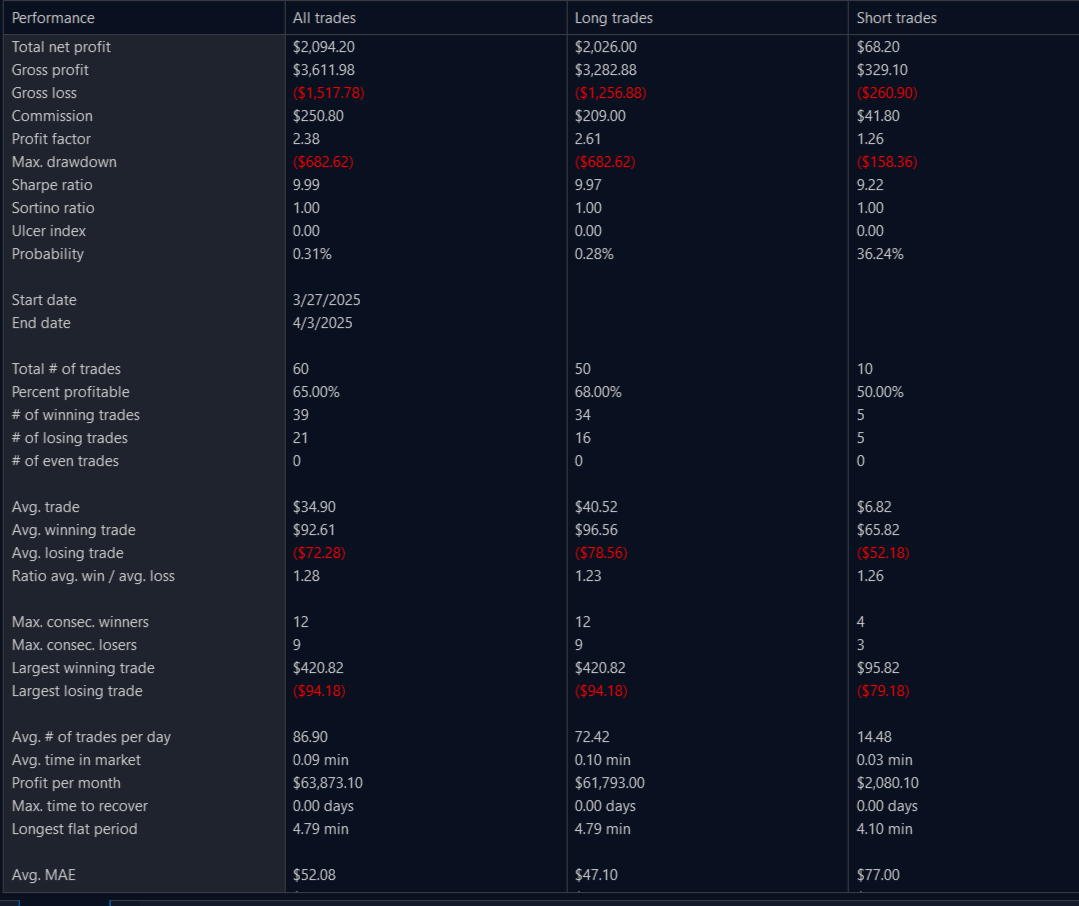

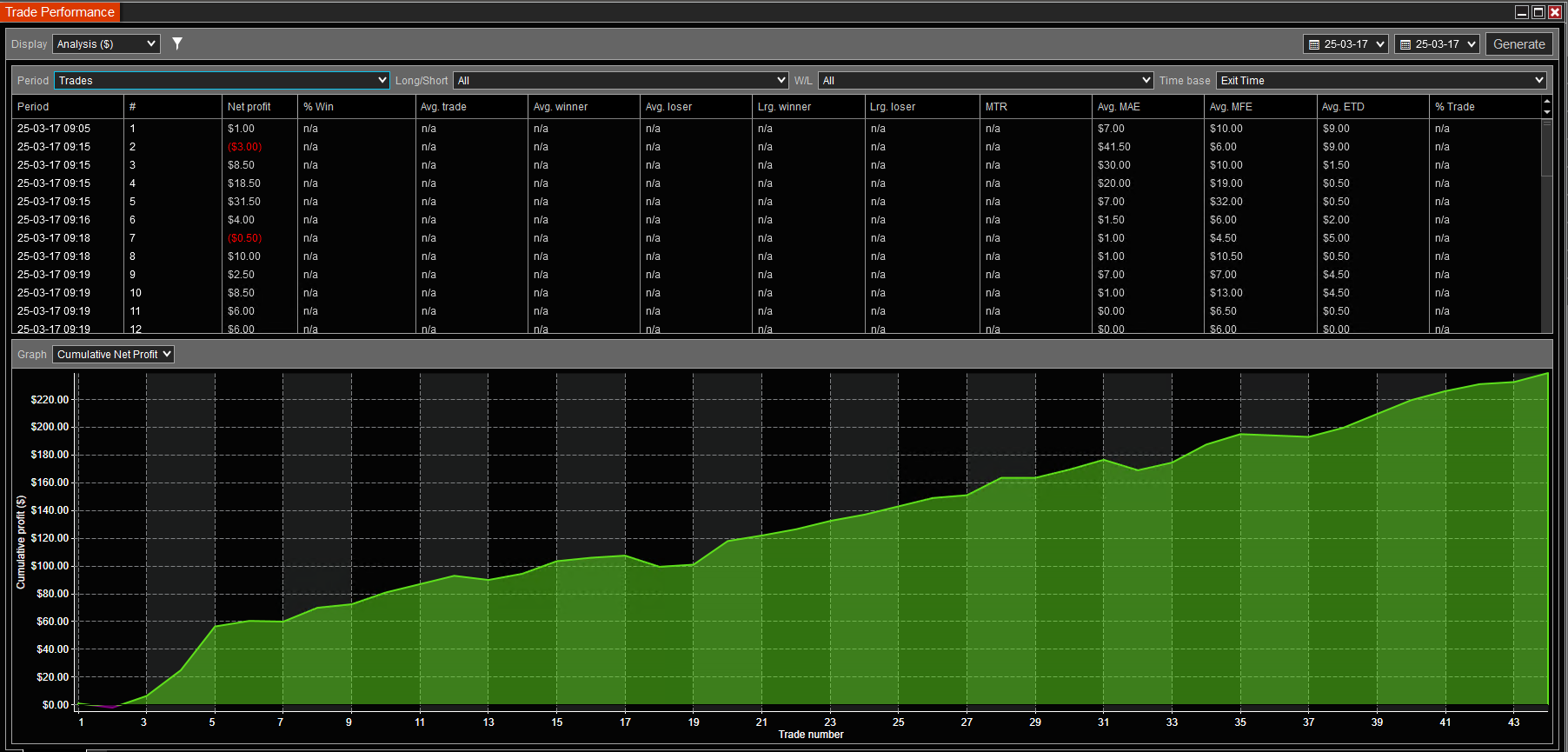

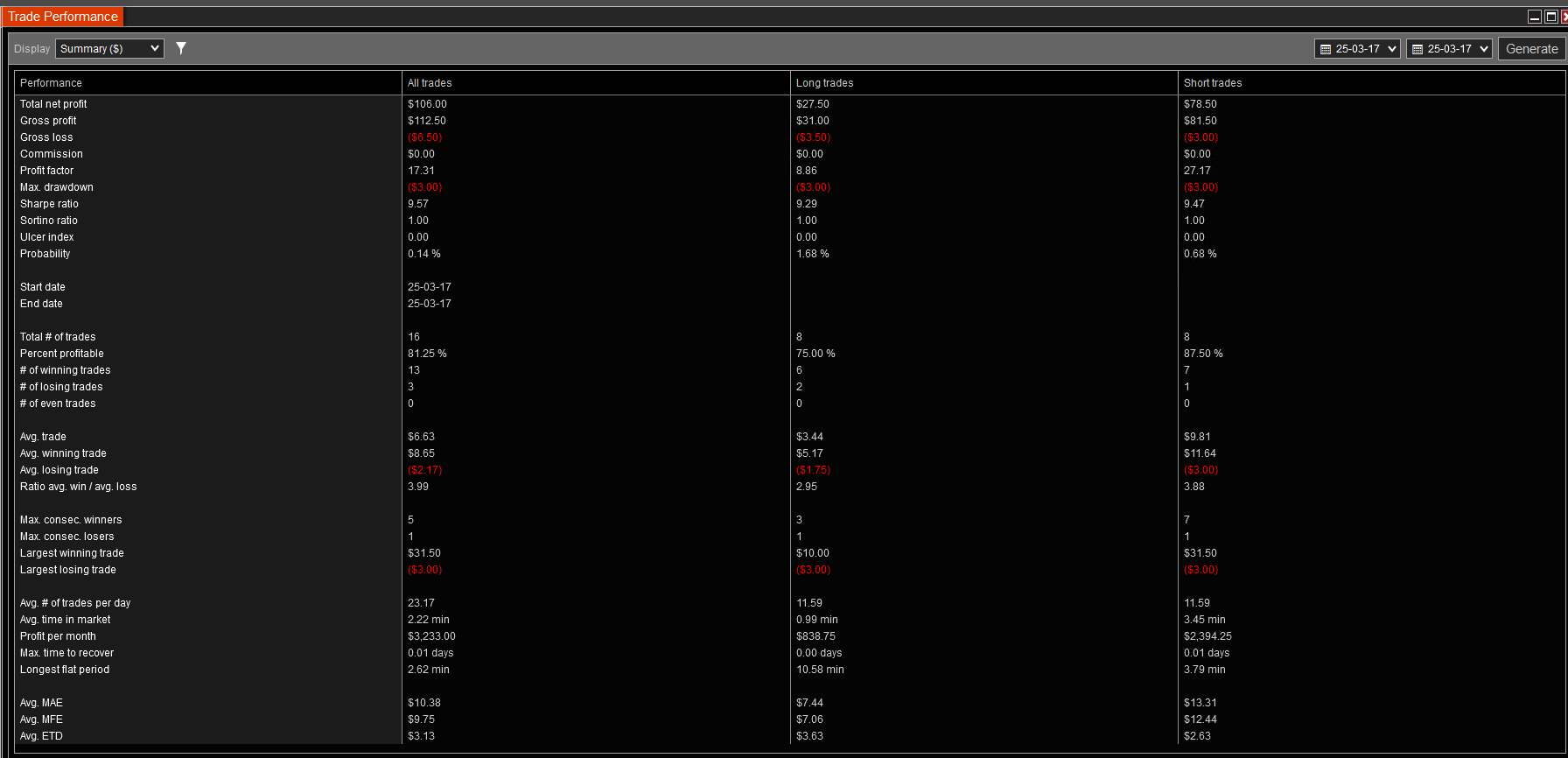

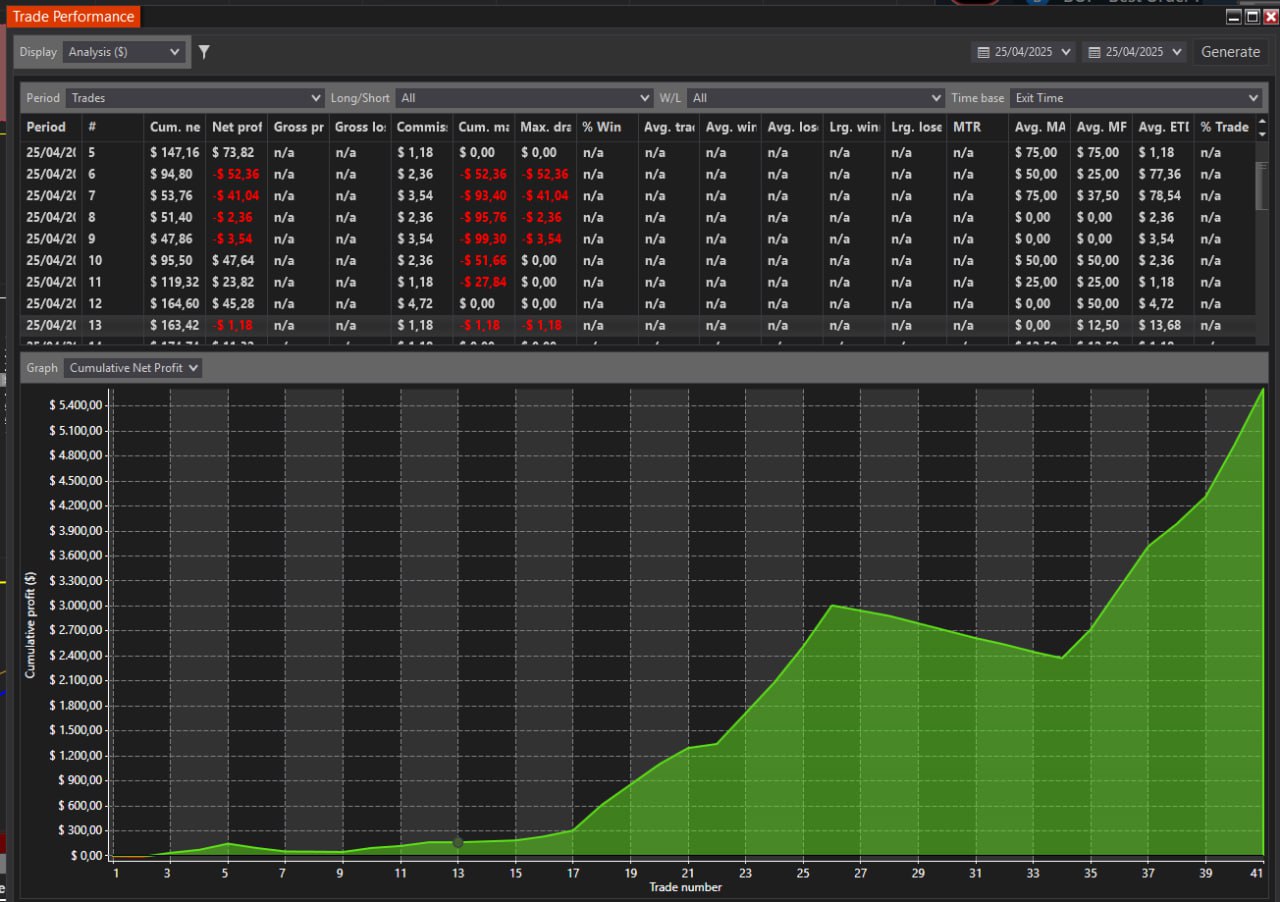

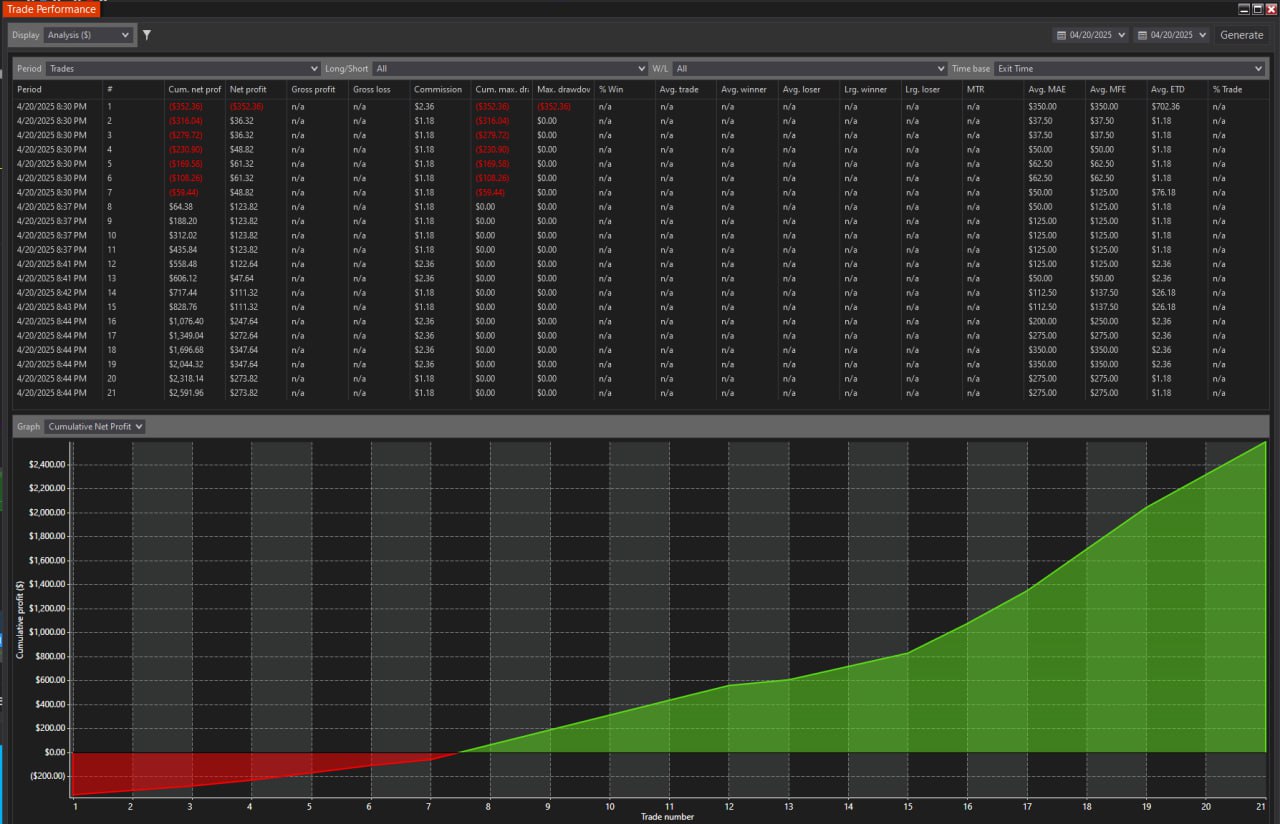

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.