MBO MARKET BY ORDER - PACK 4 INDICATORS LIST

- Pack 5: The MBO indicators pack 4 utilizes data level 3 provided by Rithmic directly or via various prop companies from CME Exchange.

- The list of tickers and instruments for trading is on the CME Exchange website

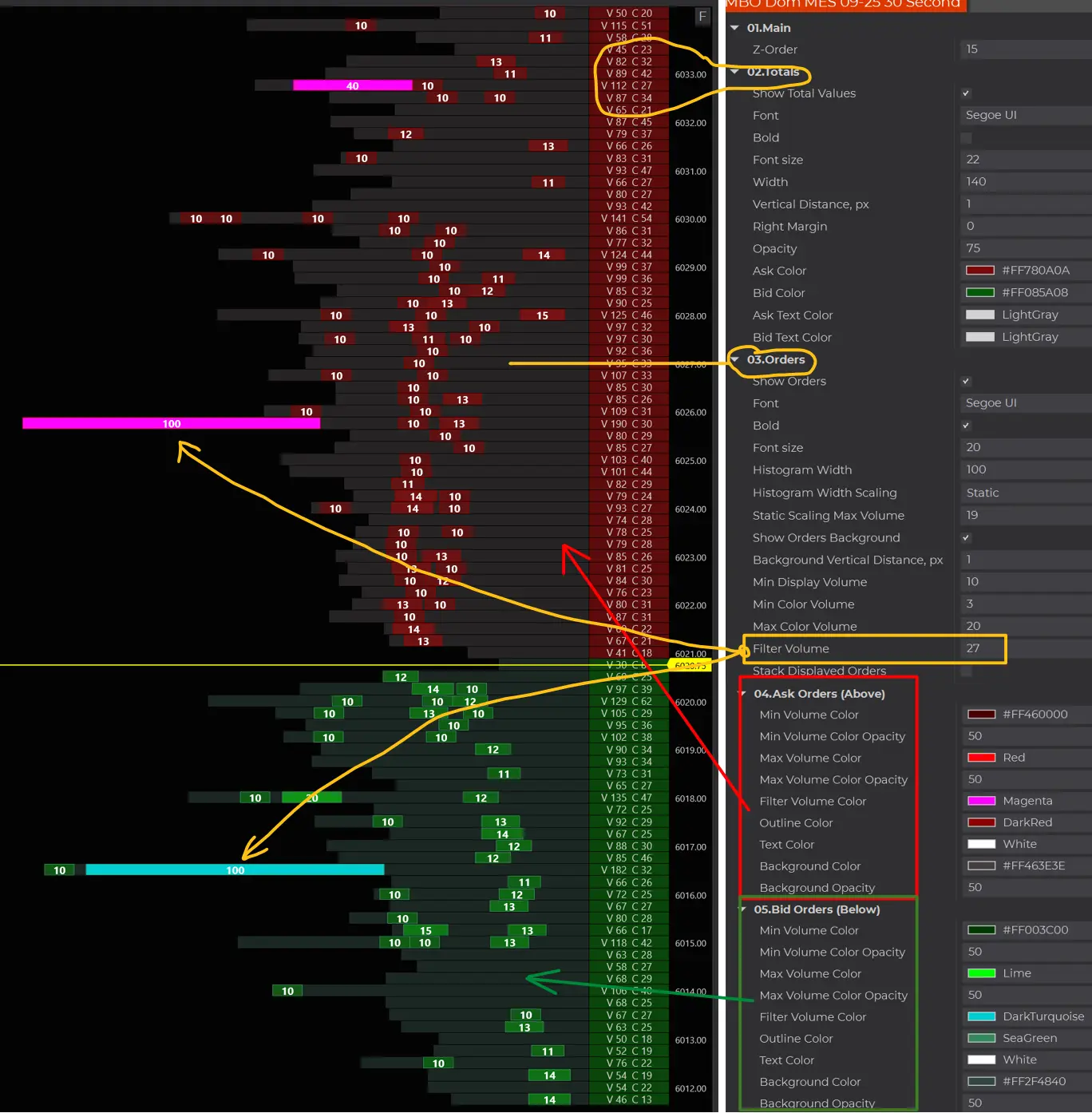

1) MBO DOM advanced

2) MBO Native Iceberg

3) Access to MBO Data Level 3 for creating your own algorithms, bots, and automation.

- MBO Icebergs are Native Icebergs based on data level 3 - Market By Order provided by CME Exchange

- Native icebergs are detected but not calculated

- Synthetic Icebergs (soon)

- Stop Loss triggers (soon)

MBO - Market By Order Definition:

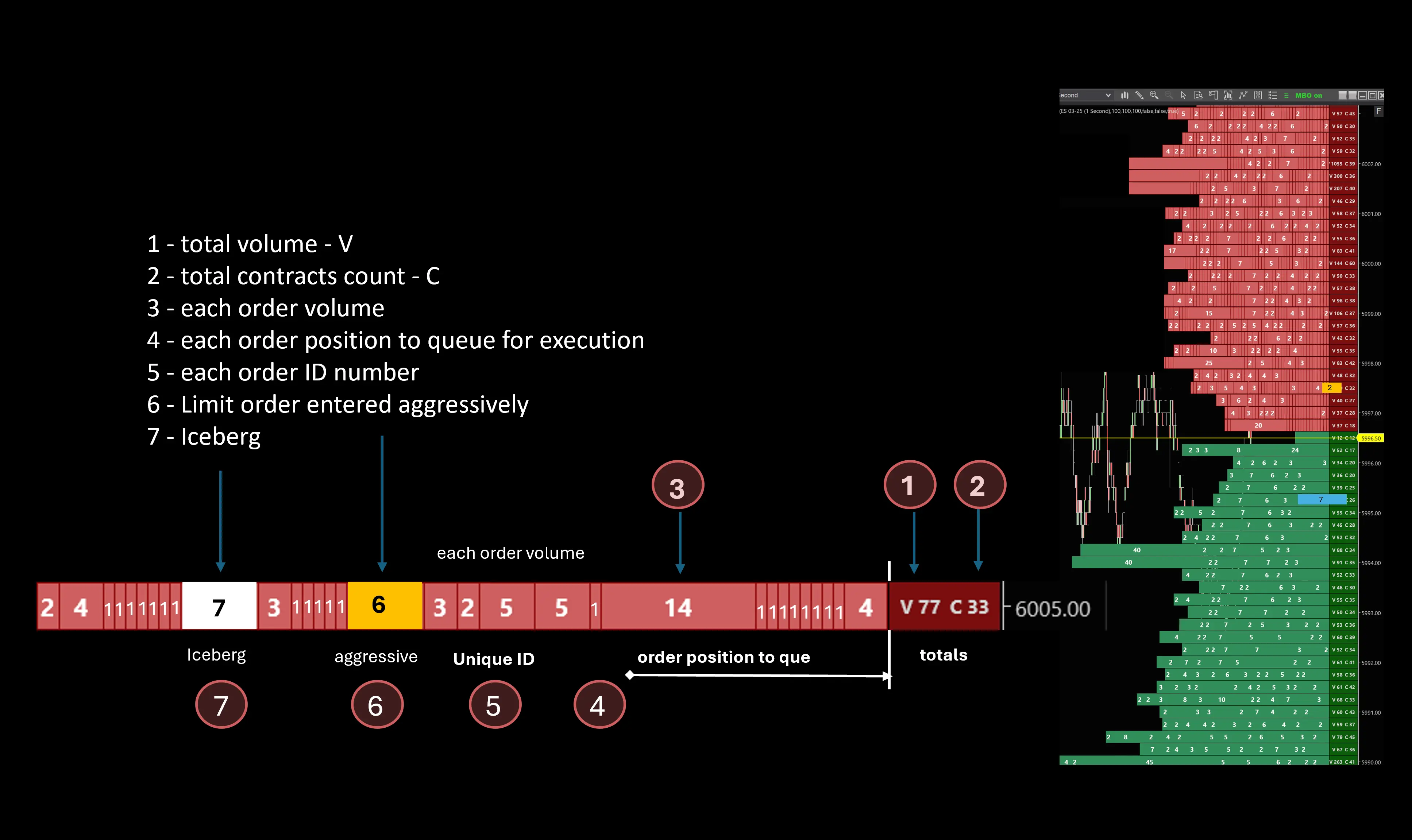

Definition: Market by Order (MBO) provides level 3 data as an order-based data feed, allowing users to view the individual order size, order ID, and queue position for each order. This represents the highest level of granularity possible.

MBO indicator capable of detailed visualisation of Level 3 data. Level 3 provides more granular and detailed information than Level 2 data and indicators.

MBO Market By Order Indicator tracks granular data for each order:

- Each order volume,

- Each contract ID number

- Order position to queue for execution

- Total limit order volume on each price line

- Total number of contracts on each price line

This is the first MBO Dom indicator developed for the NinjaTrader platform. It can be installed on a free NinjaTrader chart and used in conjunction with other indicators on the NinjaTrader 8 platform, available in both free and paid versions.

MBO Dom indicators use Rithmic data level 1 to display data level 3. Yes, that is true. MBO Dom displays level 3 data, which is more granular, as illustrated below.

- Advanced filters (coming)

- Access to Data (coming) for automation/ bots/ algo creation with built-in NinjaTrader Strategy builder

- For example, Level 2 data provides only the total volume for passive resting orders at the price level. At the same time, Level 3 data also includes the distribution of particular orders and their position relative to the queue execution.

Tracking genuine "Native" Icebergs without MBO Level 3 data is impossible.

MBO Market By Order Strategies:

Sniper MBO strategy real-time live example video:

How to use MBO for high precision entries:

It is possible to develop strategies solely based on MBO, such as the Sniper MBO video example.

MBO is an excellent cofactor for:

- Pullbacks

- Trend reversals,

- Identifying Market Maker,

- Price Rebounding,

- Support and Resistance levels and zones.

- Stop loss position

- Profit Take position

Watch more videos below on this page on how to use MBO Dom with other strategies

Iceberg Indicator for NinjaTrader

There are two types of icebergs detection:

- Native iceberg

- Synthetic Iceberg

Iceberg orders help address key challenges in trading large quantities, such as impact cost and freeze quantity. Larger trades tend to move the market price more significantly. For high-volume traders, a rapid price change incurs additional costs and can exceed other fees.

An Iceberg Order is a large order designed to hide its full size from the market. It divides one large order into several smaller, visible parts, hiding unfulfilled waiting orders from the order book.

Entering one large order in portions and gradually over time reduces market impact and significant price change, and prevents alarming other traders.

Iceberg orders help to solve the Freeze Quantity problem. Freeze Quantity:

- Exchanges impose a freeze limit, which is the maximum number of contracts allowed in a single equity derivative order. Traders placing large orders often need to split them into multiple smaller ones, which can be inconvenient.

Iceberg Orders address this by allowing large trades to be executed in smaller tranches, while appearing as a single order. This reduces the need for multiple entries, helps lower impact costs, and streamlines the process for large trades.

Details for Native Iceberg:

In trading, a native iceberg order is a significant buy or sell order, a passive limit and resting order that is split into smaller, visible portions by the trading exchange itself, using its algorithm, to hide the actual size of the order. This allows traders to execute large orders without significantly impacting the market price or revealing their intentions to other market participants.

Large Order, Hidden Size: An iceberg order is a large order that is too large to be executed easily without affecting the market price.

Visible Portion on an Iceberg: Only a small part of the total order is displayed in the order book at any given time, much like the tip of an iceberg.

Hidden Portion on an Iceberg: The rest of the order remains hidden from other market participants, making it appear as if there is only a small order in the book.

Exchange-Managed: Unlike synthetic iceberg orders that are managed by the trader's software, native iceberg orders are handled directly by the exchange's system. The Chicago Mercantile Exchange (CME) is an example of an exchange that provides services for native iceberg orders.

Native Iceberg Dynamic Reload:

As the visible portion of the iceberg order is filled, the exchange automatically replaces it with another portion from the hidden part, creating the appearance of a continuous order.

Purpose of using Native and Synthetic Icebergs:

The primary purpose of using iceberg orders, including native ones, is to minimize the market impact of large trades and avoid revealing the trader's full intentions to other market participants.

Native Iceberg Detection with BOF Indicator:

Two iceberg indicators developed by BestOrderflow.com (BOF) on a NinjaTrader platform capable of detecting and tracking icebergs in real-time by analyzing MBO Market By Order data Level 3.

False Iceberg detection claims: Some other well-known companies that claim to detect icebergs without MBO data misinform their users about the true nature of their iceberg calculations. They are capable of detecting only some "maybe iceberg, may not be iceberg," or " I guess it is iceberg." Some software names its icebergs as "Ideal icebergs," which are far from ideal.

It is impossible to visually or programmatically identify Native icebergs by analyzing order flow on a footprint. Yet some well-known and popular software developers are teaching visual iceberg detection on their YouTube educational videos. Those who claim to identify icebergs visually cannot distinguish between absorption and Native icebergs. It is pure marketing and a misleading practice.

BestOrderflow is developing the Native Icebergs indicator based on MBO Market by Order level 3 data. This is the only way to detect the native origin of icebergs and track each iceberg's growth and progression in real-time.

Advantage MBO-based Icebergs developed by BestOrderFlow ( BOF):

- Detect the historical origin of an iceberg

- Detect the volume used

- Detect the amount of additional volume

- Detect iceberg migration on the chart

1) If someone is selling you Icebergs and they are not on MBO data, that is not real icebergs - not Native icebergs. Real icebergs are sourced from the CME exchange and are based solely on MBO Level 3 data. The keyword is NATIVE. Not Ideal, not natural, or something else. (Some well-known company uses the word Ideal, and that means something other than NATIVE)

2) There are many indicators out there that sell Icebergs. Most of them are not genuine or native icebergs. Many indicators are built with incorrect formulas based on calculations of Level 2 data. They do not have a way to filter out real icebergs from newly added or removed orders, known as Synthetic Icebergs.

They do not remove orders from MarketMakers, algorithms, and bot orders, and give you a mix of those orders as icebergs. They know that most traders do not understand how to distinguish Native Icebergs and Synthetic Icebergs. And they have their weird formulas for Synthetic icebergs, which, most of the time, are incorrect and misleading.

3) The 100% correct Icebergs placed by CME exchange and detected (not calculated) with each order ID based on the Level 3 data only. It is called Native MBO-based Icebergs. The real icebergs indicators must state that their Icebergs are based on MBO.

If they provide a nice explanation without a clear statement about MBO-based detection (MBO - Market By Order), it means they do not have 100% Authentic CME Icebergs. They are good marketers, selling their "sheet" as an iceberg.

4) Some companies that specialize in MBO - market by Order - have INCORRECT iceberg detection, masking it as IDEAL ICEBERGS. IDEAL icebergs means - their version of an iceberg instead of a 100% REAL CME-based iceberg.

5) With BOF - bestorderflow.com, you are getting authentic 100% CME and MBO-based Native Icebergs. Period.

—No more fakes, no more marketing, no more shenanigans. We do not sell you "junk icebergs" as many others do.

MBO MANUALS AND INSTRUCTIONS

Manuals / Instructions / Explainer about how to set up MBO Dom and Iceberg (in development) Indicators

Download Step by Step MBO Dom Market By Order Manual ![]() PDF

PDF

PDF MANUALS

Video: Watch MBO Market By Order indicator video explainer

Video: How to set up preferences for MBO Dom Market By Order indicator

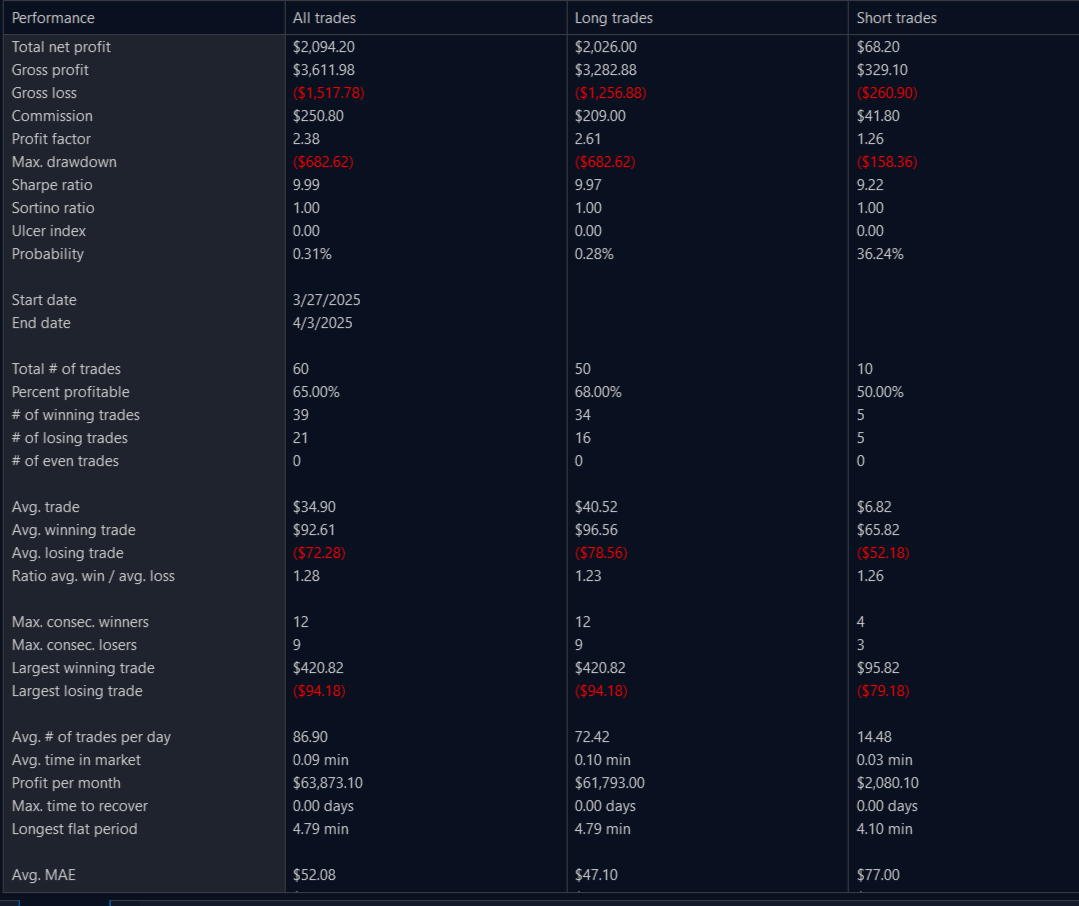

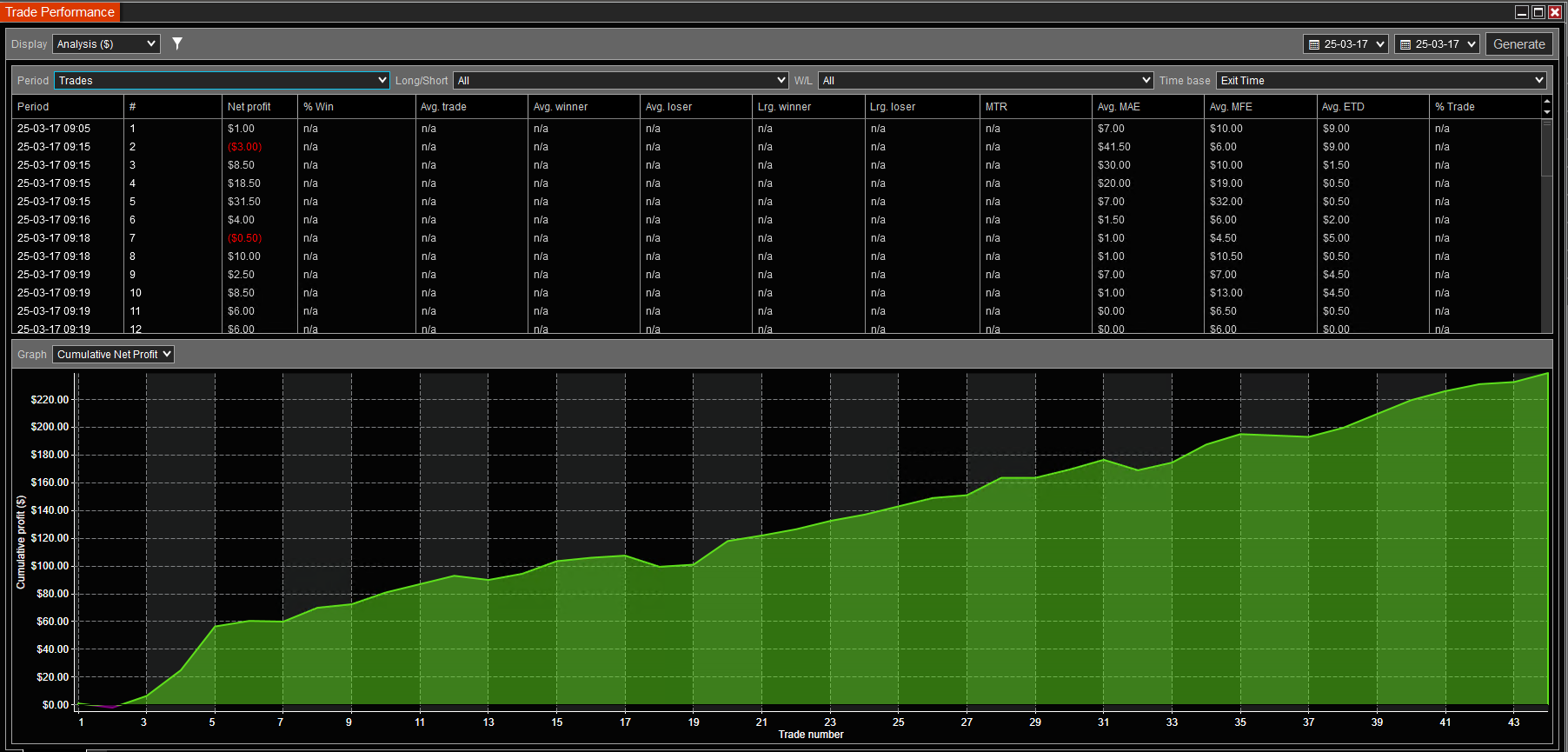

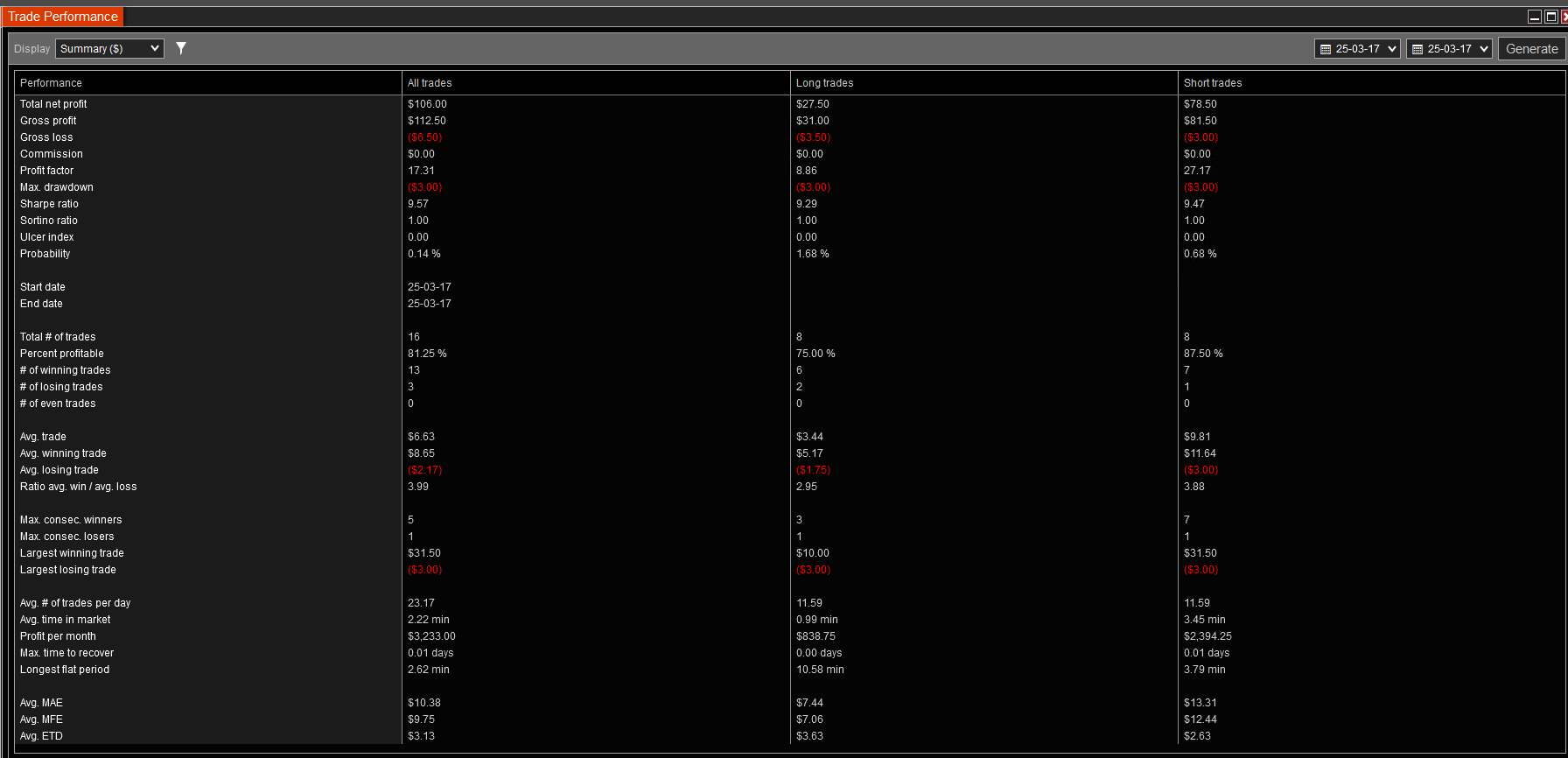

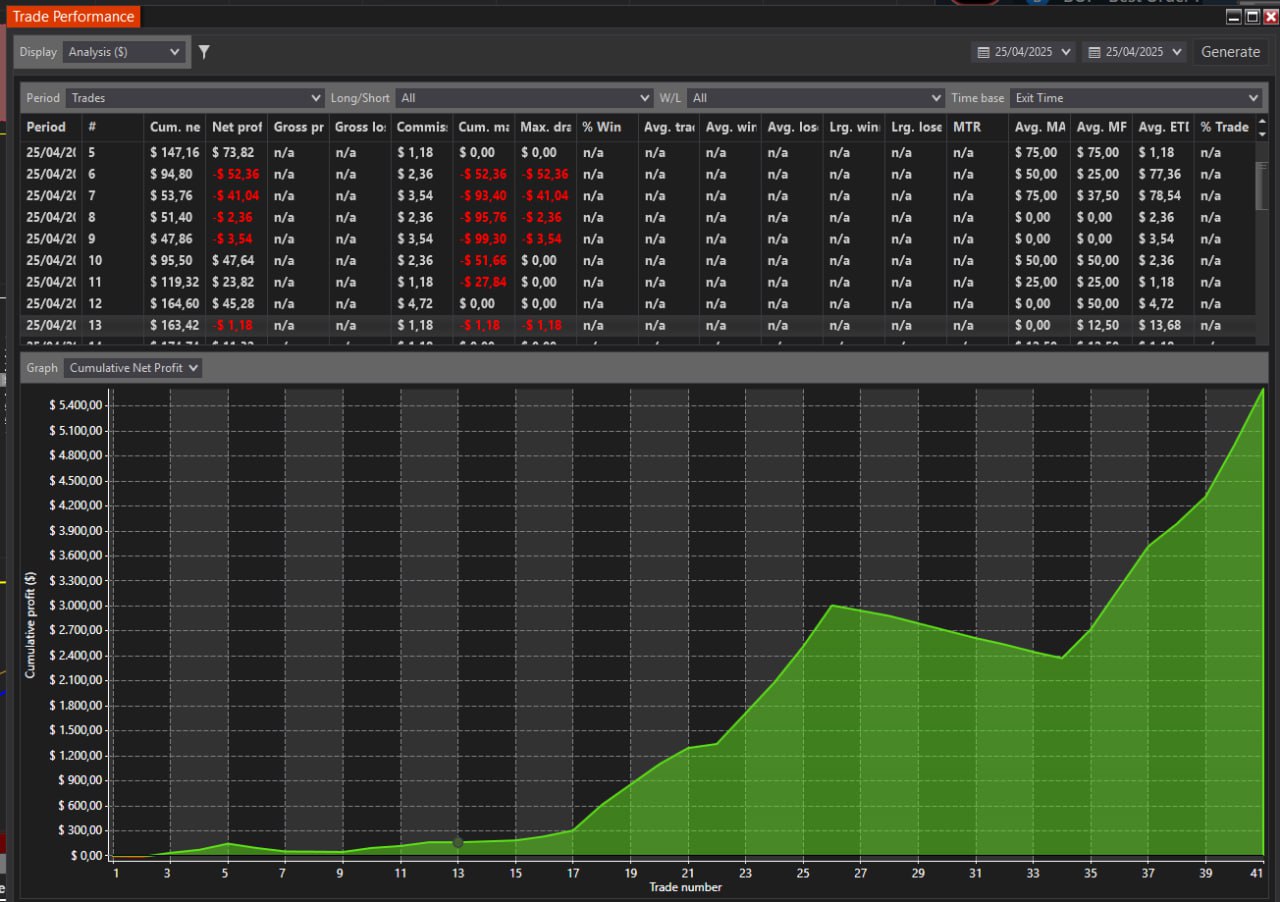

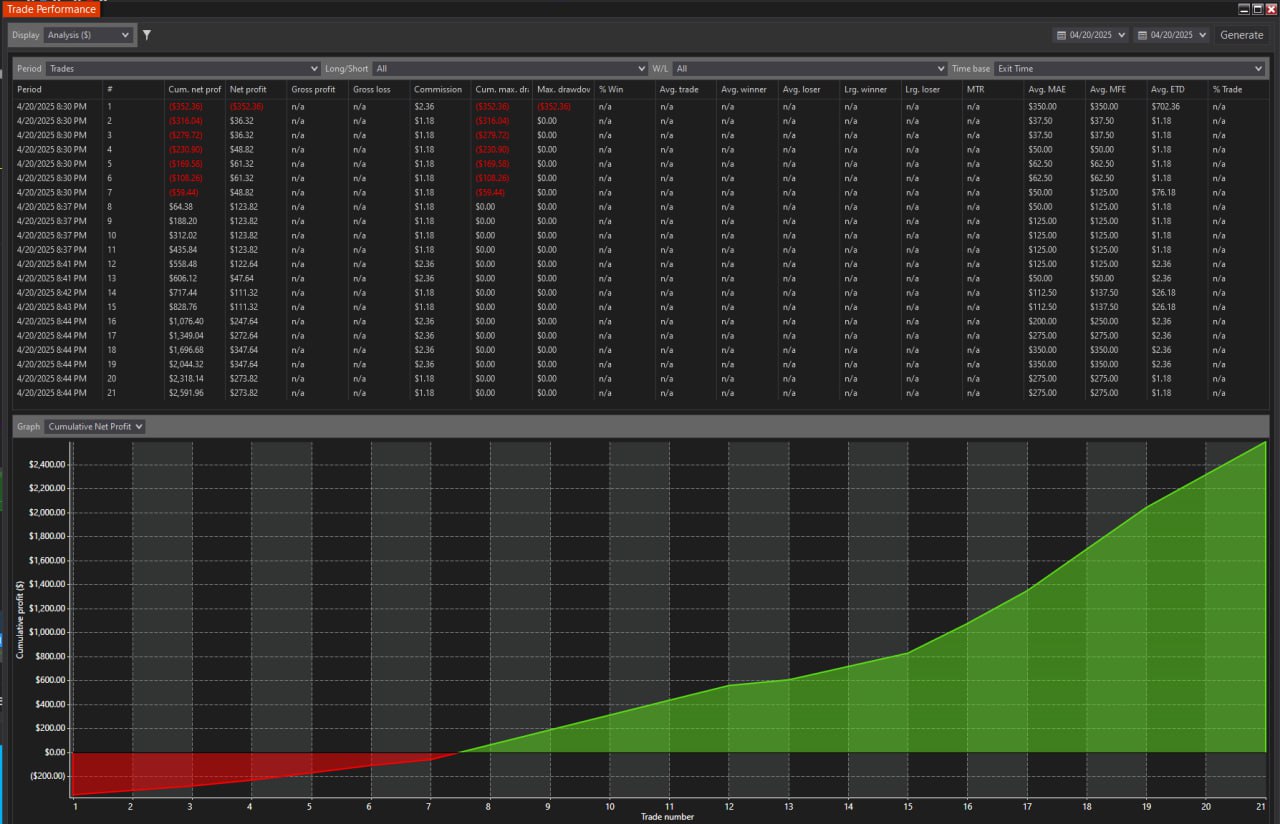

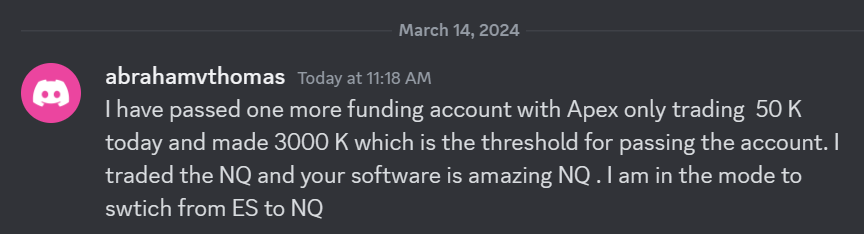

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.