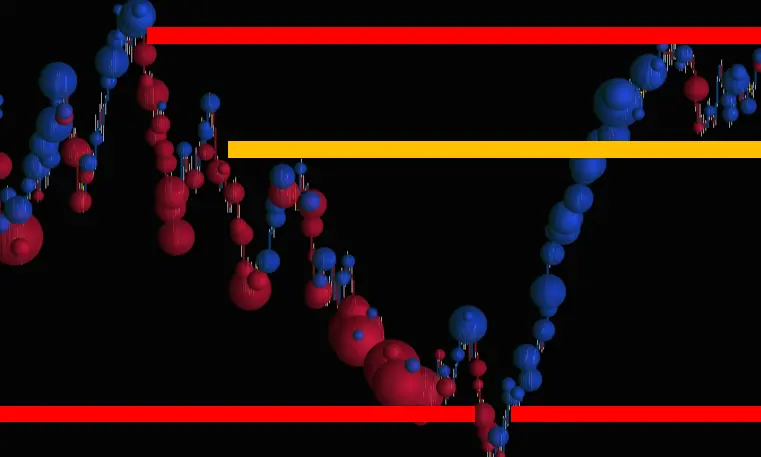

Trade All 3 Levels on the Same Chart

Mega Sale

MEGA SALE:

Coupons applicable only once:

Yearly 1st payment and Lifetime payment.

40% discount coupon ends January 17: FIRST40

35% discount coupon ends January 24: FIRST35

Limitations:

- Coupons do not apply to any monthly subscriptions.

Premium Quality

- Fully Integrated indicators

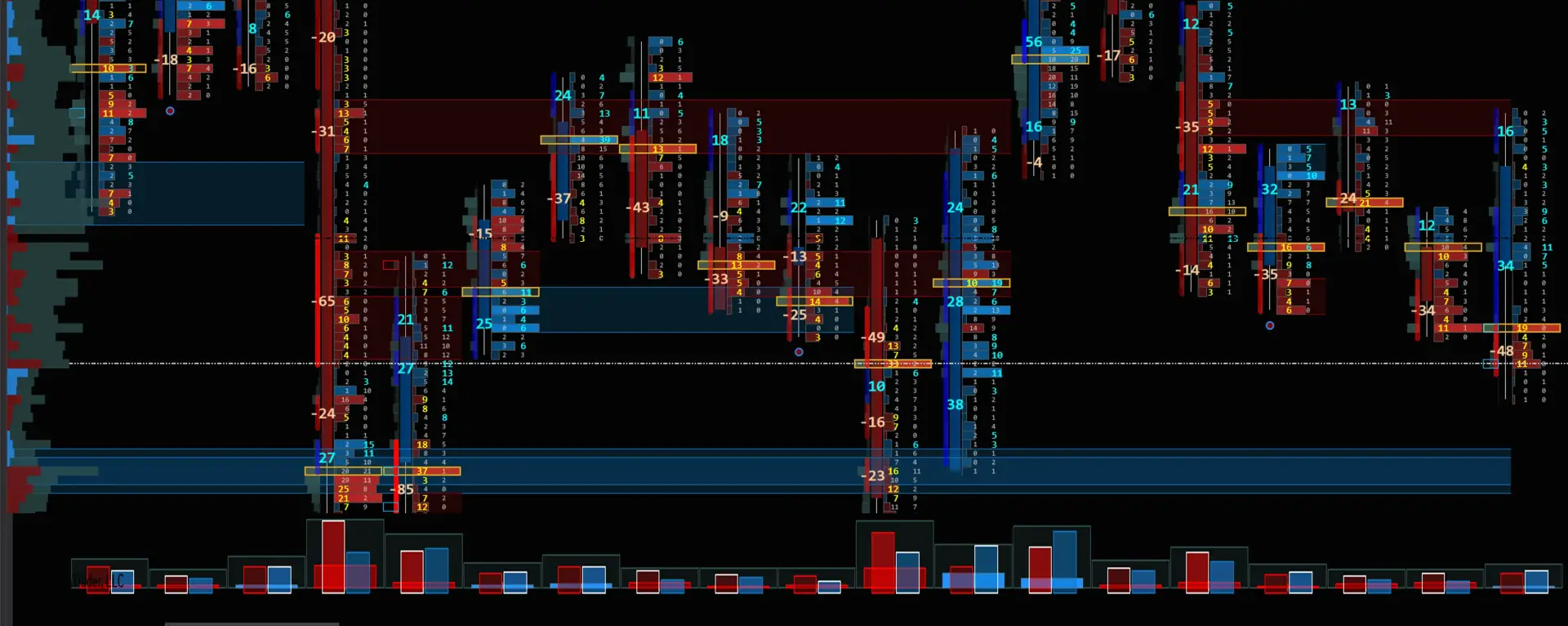

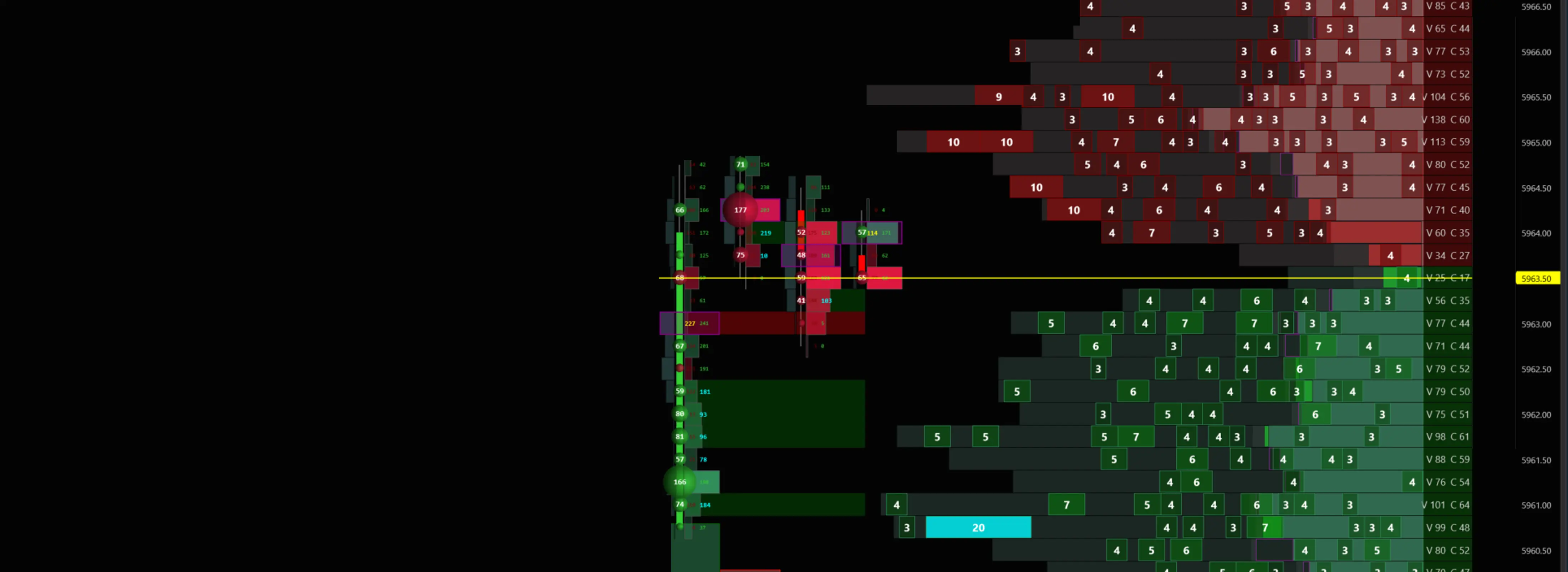

Level 1+ Level 2 + Level 3 data - Speed tested on high ATR and extreme volatility:

Footprint, Heatmap, PastDom, MBO DOM, MBO Icebergs - Compatibility performance:

All indicators run on the same chart without interference and delay. - Optimized for high-speed automation and HFT trading

Contact and Support

- FREE Support only if you qualifyed users

- Paid Support for discqualifyed users

Learn here How to Qualify or Disqualify for FREE support

Contact for general questions:

Monday-Friday 8 AM - 5 PM Pacific Time

Connect on Discord link Connect on Telegram link

We are off for the weekend: Saturday and Sunday - off.

SUPPORT CHANEL:

Support provided only with Direct messaging with BOF Admon on the Discord here: Discord: https://discord.gg/2CJAuQ87GY

Please do not use Telegram for support.

Got problems and need additional support?

Did you try to fix your problem on your own before seeking help?

Our How To User Guide is a comprehensive collection of solutions for almost any issue or problem you may encounter. Try to solve them on your own before addressing them with BOF Admin.

GET SUPPORT PROPERLY:

Before contacting our support with any issue or problem,

Please follow the How To User Guide links with solutions for:

- Requirements for the NinjaTrader platform

- Requirements for a PC computer

- Requirements for Time Synchronization

- Requirements for Internet Connection

- Solutions for your account on this website

- Solution for Machine ID and activation

- Solution for BOF indicators installation

- How to Uninstall , Remove or Delete BOF indicators

- Troubleshooting checklist

- Errors on NinjaTrader

Request support and assistance from BOF Administrator only after you have gone through:

- Troubleshooting checklistTroubleshooting checklist

- Preparation for getting support checklist Preparation for getting support checklist

The first question you're going to get from the BOF Administrator is:

Did you review the Preparation for Support Checklist and the Troubleshooting checklistTroubleshooting checklist

Contact with general questions about BestOrderFlow Indicators:

Connect on Discord link Connect on Telegram link

Join our Discord community of traders practicing BestOrderFlow indicators technologies:

Reasons to join our community:

- See real results by community members

- Get direct support from the BOF Administrator

- Attend Live Support Q and A on webinars every Monday at 7:00 PM Eastern Time, 4:00 PM Pacific Time

- Download Manuals and user guides for indicators

- Download ready-to-use templates

- Learn Trading strategies.

- Community of traders

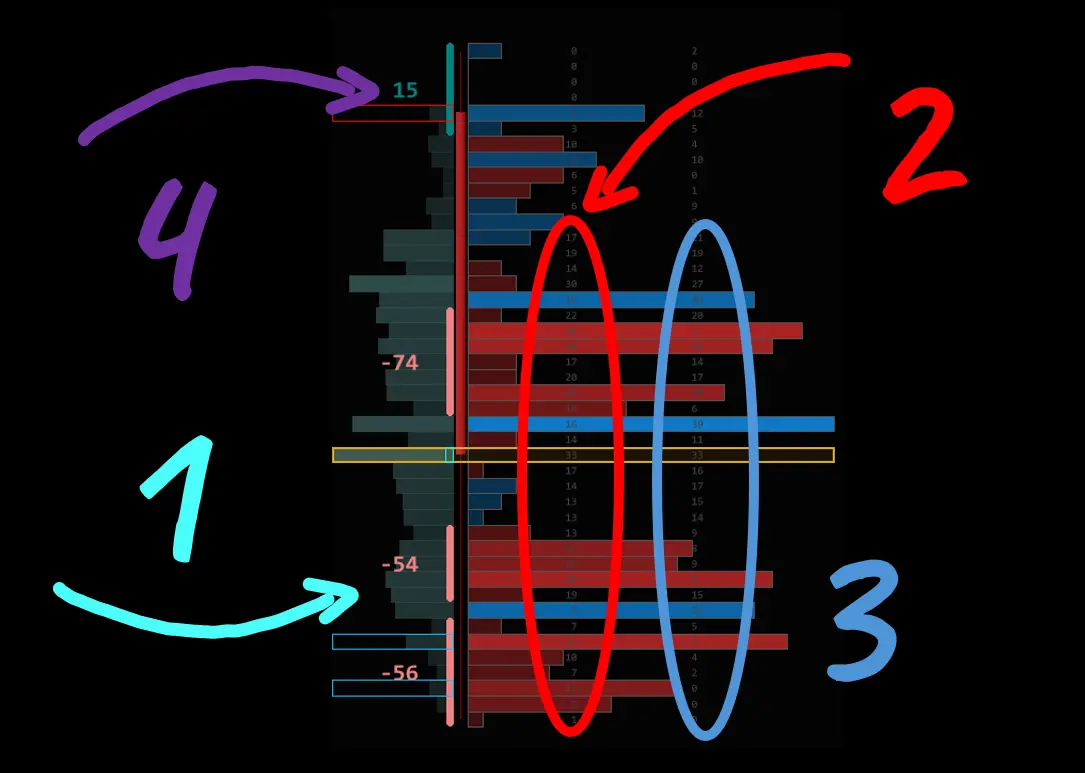

The main difference

We build professional-grade indicators for speed and performance:

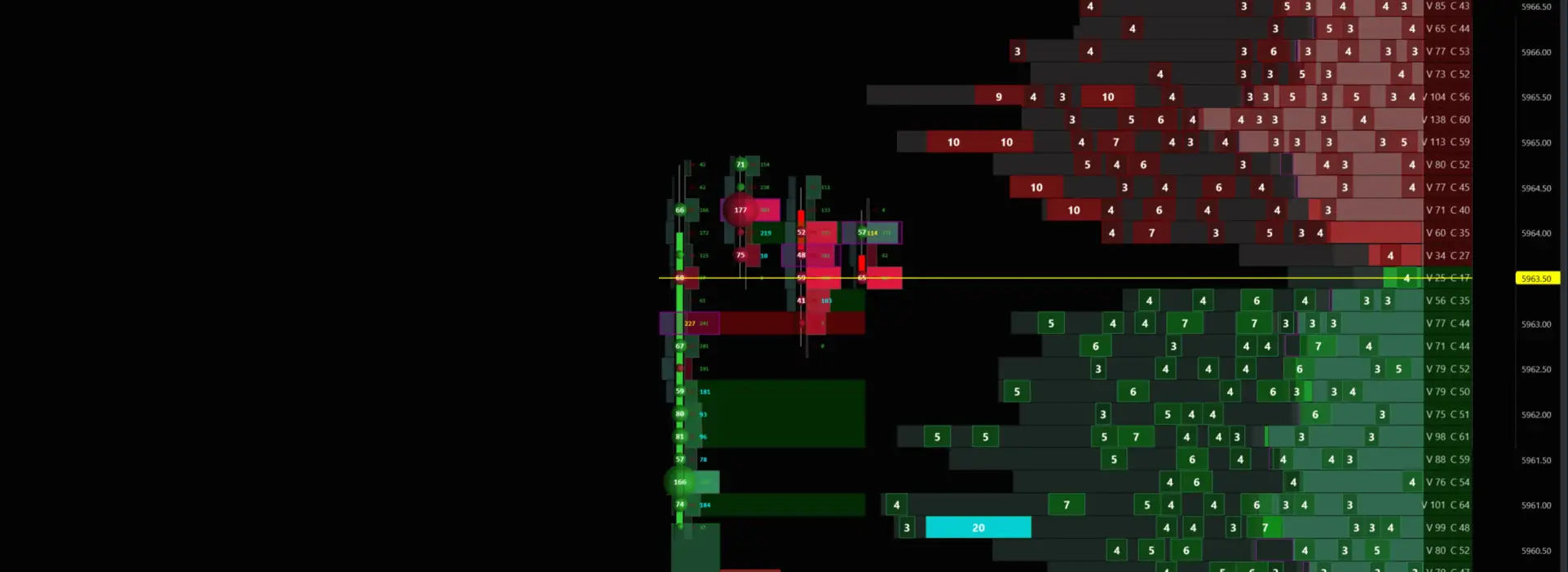

- BOF - BestOrderFlow is the first to release the MBO Market By Order DOM for trading on NinjaTrader charts.

- BOF - BestOrderFlow is the first to release Depth of Market Dom and Heatmap NT, which does not freeze during periods of high volatility and ATR

The Ledger heatmap is the only professional-grade heatmap that keeps working during critical times during a high-volatility NY open and does not freeze, unlike the others. - We tested all third-party indicators, including BOOKMAP and other Heatmap(s), and based on solid data tests, discovered their insufficiency in speed and accuracy in performance during extreme volatility.

- We tested other third-party Icebergs and found that their nature of Icebergs is based on calculations of level 2 data instead of level 3 data.

- True icebergs can be built only on Level 3 data, such as Market by Order (MBO).

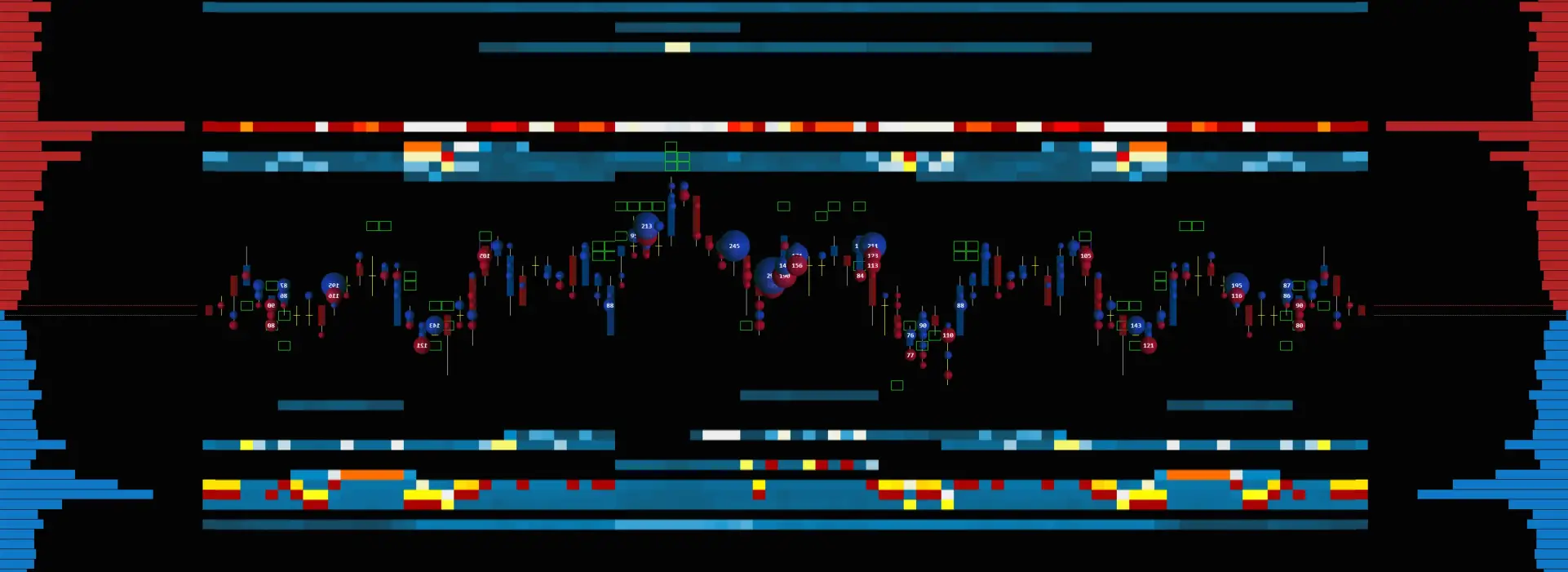

Complete Orderflow paks of Indicators:

- Pack 1 - Aggressive liquidity indicators: advanced Footprint

- Pack 3 - Passive and Aggressive liquidity LEDGER HeatmapPack 3 - Passive and Aggressive liquidity LEDGER Heatmap

- Pack 2 - Passive liquidity: advanced SuperDom Pulling and Stacking

- Pack 4 - Instant liquidity: Market By Order MBO DomPack 4 - Instant liquidity: Market By Order MBO Dom

Most traders don't know:

If your automation is based on slow and not tested on speed indicators, it is a waste.

Build automation based on BestOrderFlow super-fast indicators to outperform:

- Bots,

- Algos,

- High Frequency Trading, NinjaTrader Strategy

- Automation built with BOF indicators outperforms automation built with any other "Lego" type of software for NinjaTrader. ( pending access to data for automation)

The highest level of performance on the competition test

- We are proven champions for speed

- During extreme volatility and high ATR

- Compatibility between Footprint- Heatmap and MBO Dom

We are no longer naming our Package 3 as Bookmap NT. Our new name for Package 3 is LEDGER

LEDGER NT is a record of interactions between all market participants, including both aggressive orders and passive orders. The term LEDGER is a better description of interactions between level 1 data, level 2 data, and level 3 data orders.

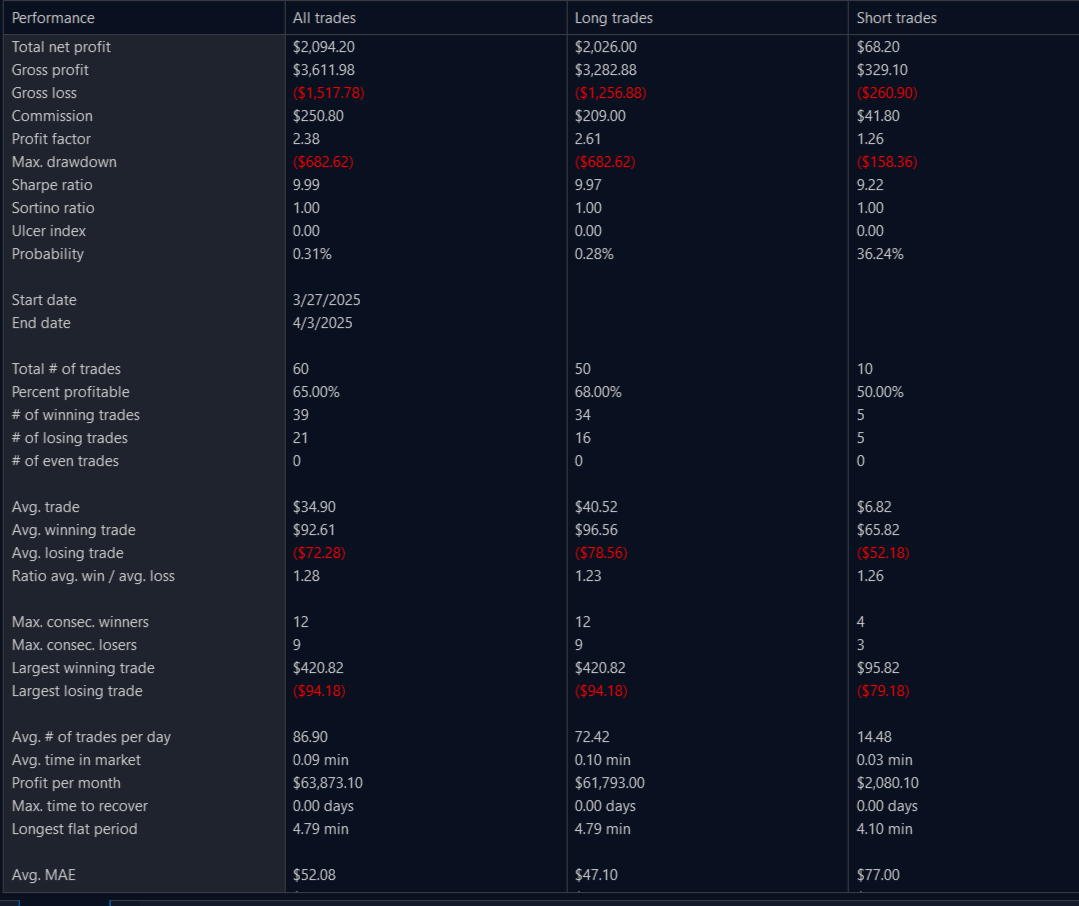

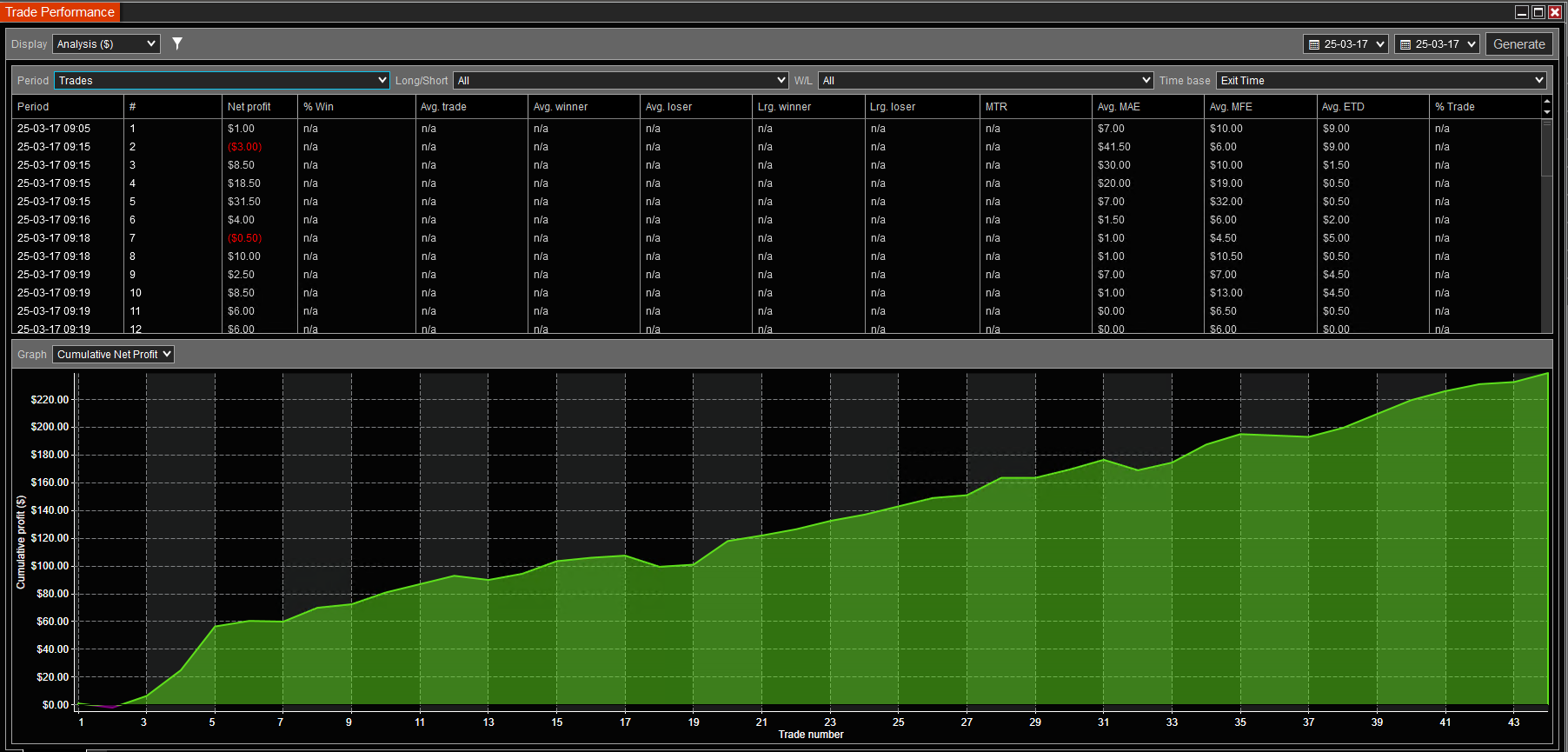

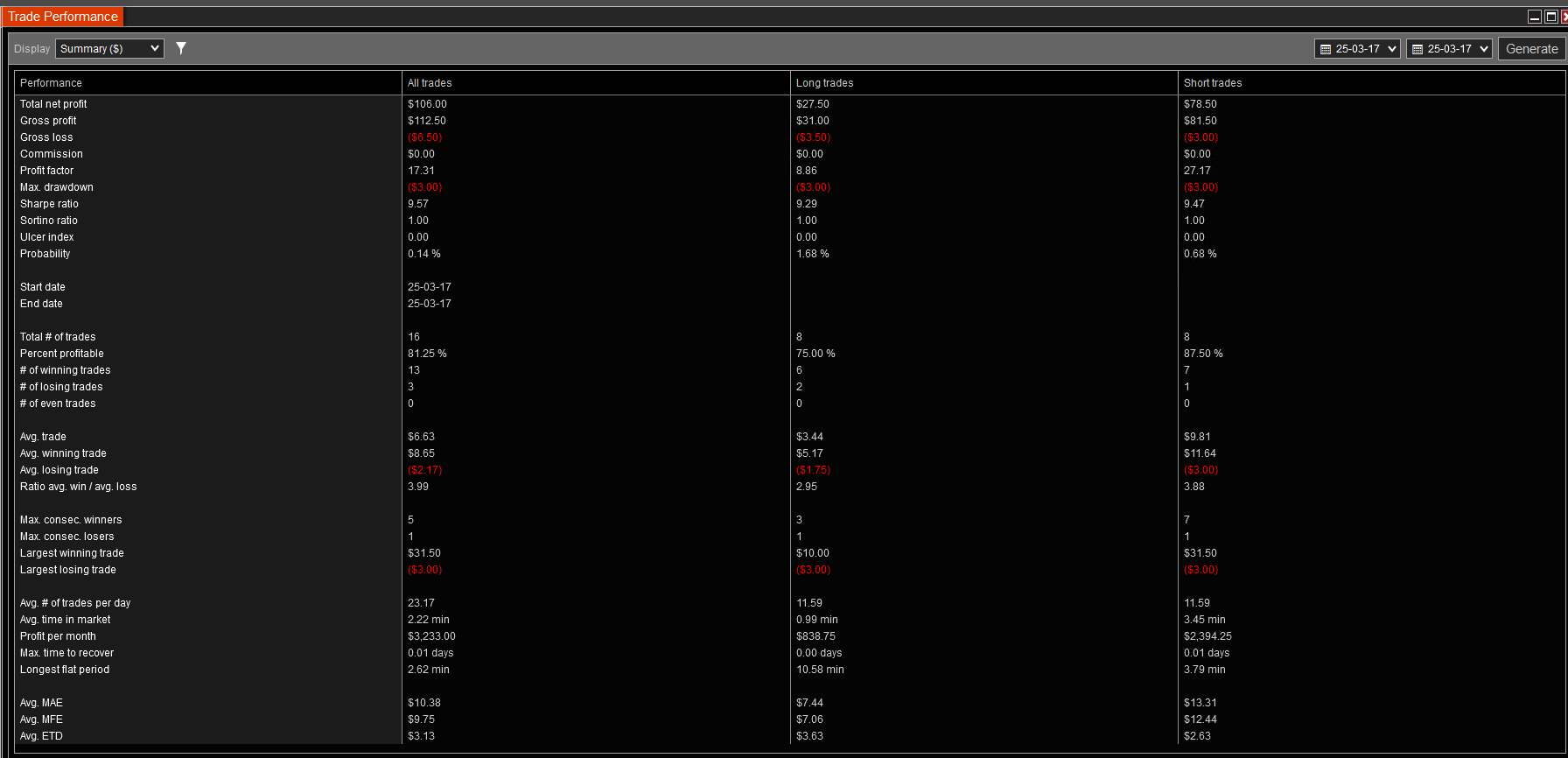

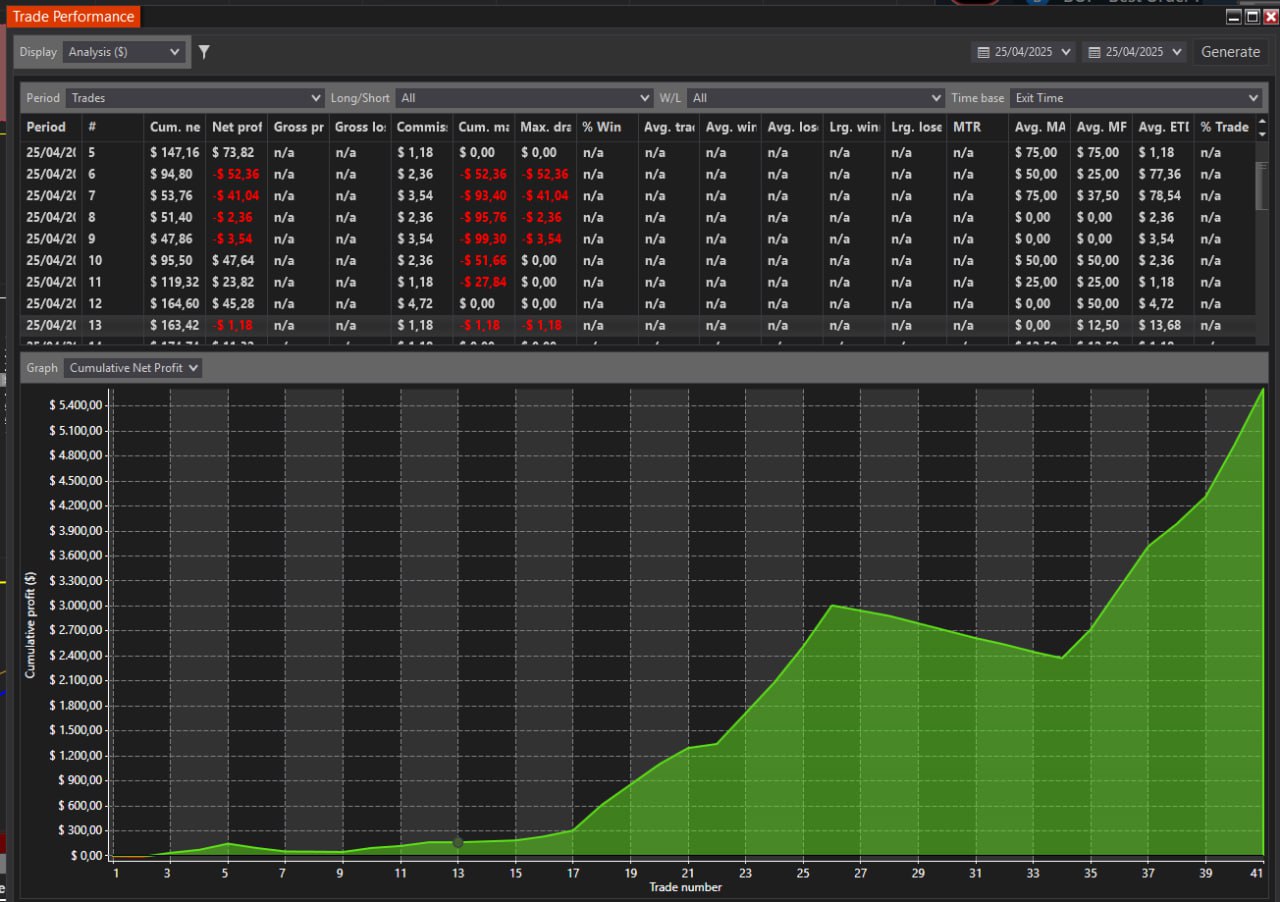

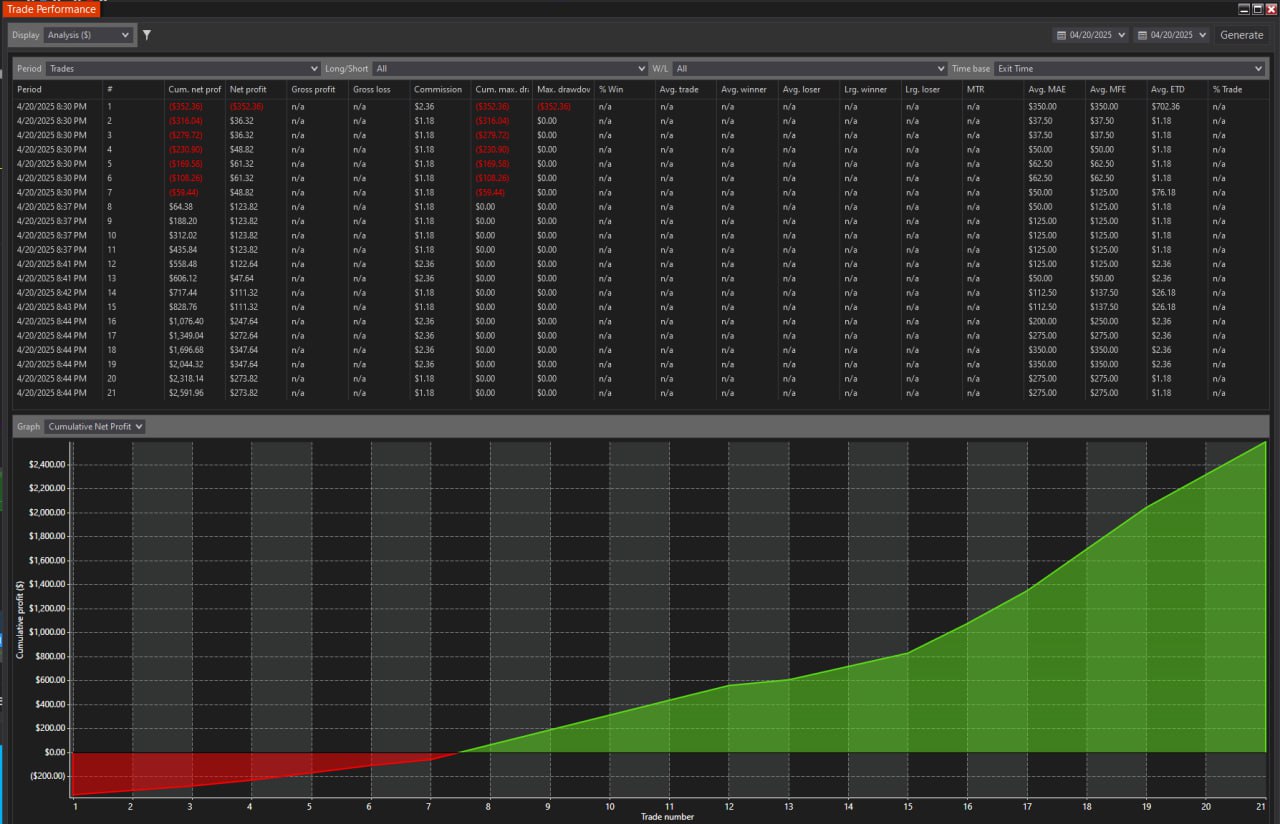

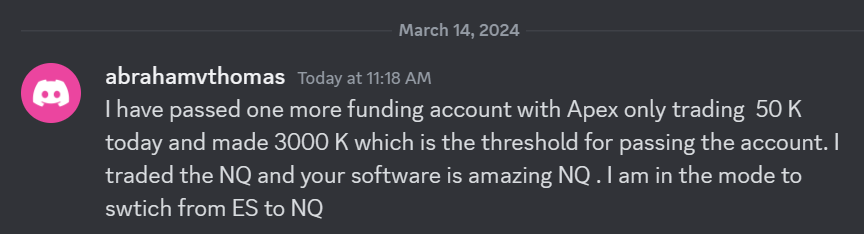

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.