Heatmap from Bookmap compared to LEDGER Heatmap

The heatmap from Bookmap.com looks pretty nice until it is seriously tested and challenged by the new heatmap developed over the past few months. After years of using it and learning the app, we found deficiencies ff that heatmap that every trader must know.

NinjaTrader users now get faster and better Heatmap charts compared to the Heatmap from Bookmap. What makes the Bookmap heatmap in NinjaTrader unpleasant to use? Here are a few key points:

- Heatmap from Bookmap is slow and lags on high-volatility charts at Market Open. It gets frozen and skips the chart rendering that becomes visible on the chart.

- Heatmap from Bookmap does not accurately display the heatmap and provides false information in the chart at the aggregation and price combination when data is summarised to show only a few price levels.

- The Bookmap heatmap is cluttered. The charts in ES and MES are always clattering with bots and algos that are hard or impossible to remove. It is hard to trade when a heatmap is cluttered.

- Heatmap bubbles are not properly sized, and there is no information about each bubble's size. Bubbles obstract heatmap.

- A Bookmap heatmap can overload the computer's CPU, causing laptops and desktops to overheat quickly.

- The Bookmap heatmap is not integrated with Footprint.

- The Bookmap heatmap is not integrated with other indicators on the trading platform, such as NinjaTrader.

- You have to dedicate a separate monitor to the Heatmap from Bookmap. What if you don't have an extra monitor?

- Bokmap's Heatmap version does not allow you to trade directly from the Heatmap Chart because it is not integrated with the NinjaTrader trading platform.

- Bookmap's heatmap color scheme uses the same set of colors for bid and ask. It takes some mental energy for a trader to distinguish passive sellers from passive buyers.

- The Bookmap heatmap is not fully integrated with MBO Market by Order indicators.

- Bookmap is distancing itself from Iceberg indicators. Iceberg indicators on a heatmap no longer make sense. Traders don't know when to use and when to avoid using icebergs, this heatmap.

What is the new Heatmap used instead of Hetamap in Bookmap? New Heatmap that is easier to use, called LEDGER from bestorderflow.com

There are a few other heatmap indicators out there, and the Ledger heatmap from bestorderflow.com is the only one that keeps working during critical times during a high-volatility NY open and does not freeze, unlike all the others.

LEDGER is an order book, an electronic registry of buy and sell orders organized by price level for specific securities. LEDGE indicators display interaction between aggressive and passive participants of the order flow.

LEDGER helps better understand why prices move.

Price moved due to interactions between buyers and sellers. Most traders do not understand that aggressive buyers cannot interact with aggressive sellers on the same side of the order flow. The passive sellers do not interact with passive buyers on the passive side of the orderflow. LEDGER indicators, such as heatmap, show resting passive orders liquidity waiting for the price to interact with the aggressive side of orderflow - aggressive orders by market. The Market Delta bubbles indicator shows the results of interaction on the aggressive side of the Order Flow. The Market Delta bubbles indicator shows aggressive participants being absorbed by passive participants.

Why does the Heatmap indicator need to be traded with the Footprint indicator on the same chart?

The Footprint over the heatmap shows who takes the upper hand in the fight between buyers and sellers. The LEDGER is a set of indicators that shows the interaction between both sides of the orderflow and which side impacts the price to move higher or lower.

The price can change due to the absence of passive participants, creating a vacuum of resistance. The price can change because passive participants provided more liquidity than aggressive sellers could absorb. The price can be changed because Agressive participants over power paqssive side of the orderflow. All of these scenarios are recorded in the LEDGER and provide data for a trader's interpretation and decision-making. LEDGER helps traders trade the entire Order Flow, not just one side, as presented in the Volume Profile or Footprint indicators.

What can Ledger Heatmap do that Heatmap from Bookmap does not? The short answer is: the Heatmap from Bookmap shows only one side of orderflow, while the Ledger heatmap shows both sides of the Order Flow.

LEDGER Heatmap is a new Heatmap developed by the programmers at bestorderflow.com.

LEDGER Heatmap advantage over other Heatmap apps/ software indicators:

- LEDGER Heatmap is fast at the high-volatility market open.

- LEDGER Heatmap is lighter-coded than Bookmap Heatmap.

- LEDGER Heatmap is optimized for Level 2 data performance during periods of critical volatility. It is a true champion among all Heatmaps ever tested for speed and performance benchmarks.

- LEDGER Heatmap is fully integrated with Footprint, Volume Profile, and Market By Order indicators.

- Trades can be placed directly from the Ledger Heatmap charts, as the charts are fully integrated with the trading platform.

- Ledger's heatmap integrated with Footprint. That means you can use both on the same chart, and that is a major improvement.

- LEDGER Heatmap from https://bestorderflow.com is a complete order flow software that represents the interaction between the aggressive side of orderflow and the passive / limit orders side of the orderflow, making LEDGER Heatmap a complete Order Flow software app indicator.

- LEDGER Heatmap supports any other indicators installed on the same chart, allowing traders to use their favorite indicators alongside LEDGER Heatmap.

- LEDGER Heatmap provides accurate information with price level aggregation. Accuracy of information is the number one priority for any indicator, especially on the Heatmap.

- LEDGER's heatmap supports more color scheme variations and allows the bid color to differ from the ask colors. The enhanced color scheme and more color scheme variations help traders make trading decisions in a snap, without extra thought on distinguishing passive sellers from passive buyers.

- The Heatmap from LEDGER is fully integrated with MBO Market via the Order indicator. It is integrated on the same chart and is fully functional Market By Order DOM.

- This heatmap from bestorderflow.com is integrated with the native Iceberg indicator. Iceberg indicators on an LEDGER heatmap make more sense and are easier to trade visually. Traders can distinguish two types of aceber directly on the heatmap and also on the DOM.

Conclusion: LEDGER Heatmap from bestorderflow.com is 10 times faster and easier to render. LEDGER's heatmaps can be cleaned and filtered to remove unwanted elements, leaving a crystal-clear heatmap with the most important liquidity. LEDGER Heatmap integrates with other indicators and complements any trading chart in NinjaTrader, allowing traders to use other indicators on the same chart alongside the heatmap. That eliminates the need for multiple displays and allows trading from the main chart, rather than requiring multiple charts and multiple monitors. LEDGER's heatmap uses significantly less CPU energy to process level 2 data and render it on the chart, resulting in faster, smoother, and more accurate data presentation.

There are a few other heatmap indicators out there, and the Ledger heatmap from bestorderflow.com is the only one that keeps working during critical times during a high-volatility NY open and does not freeze, unlike all the others.

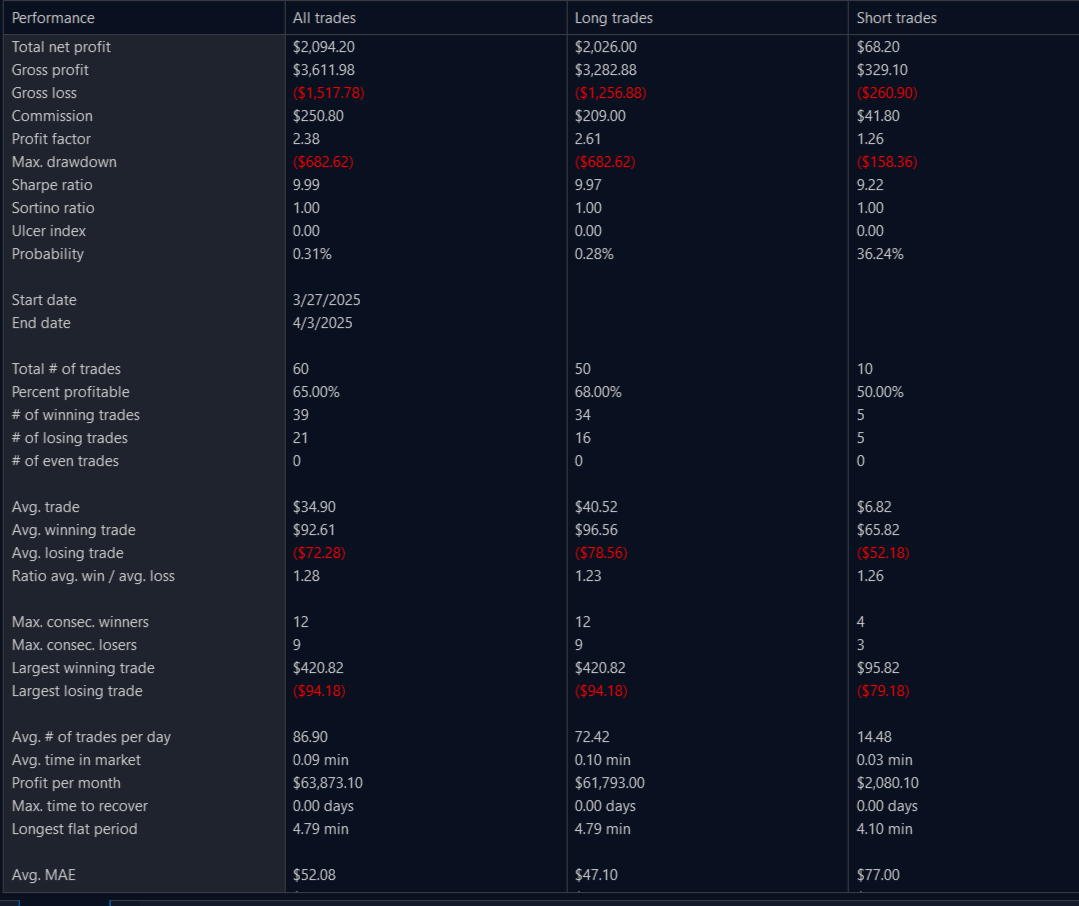

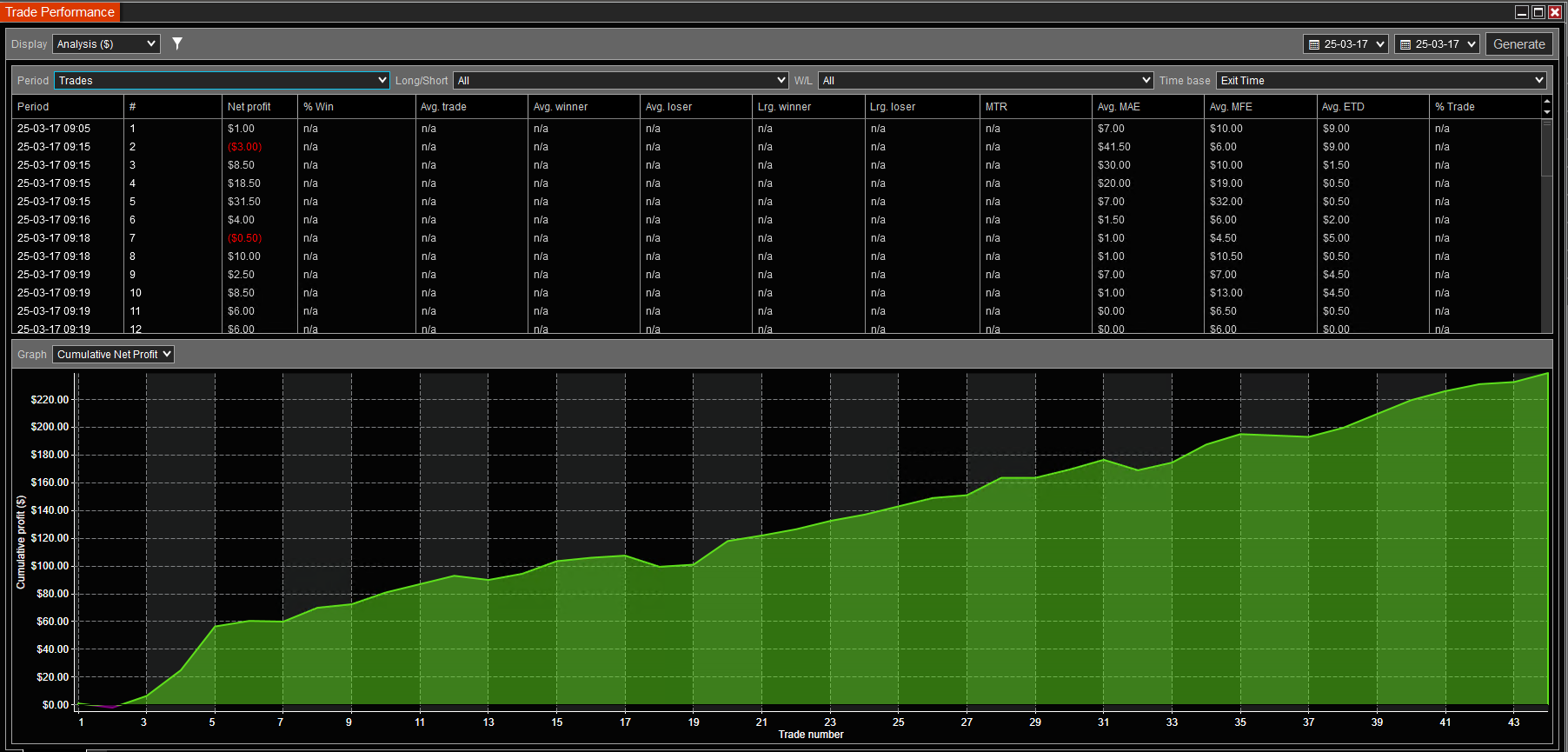

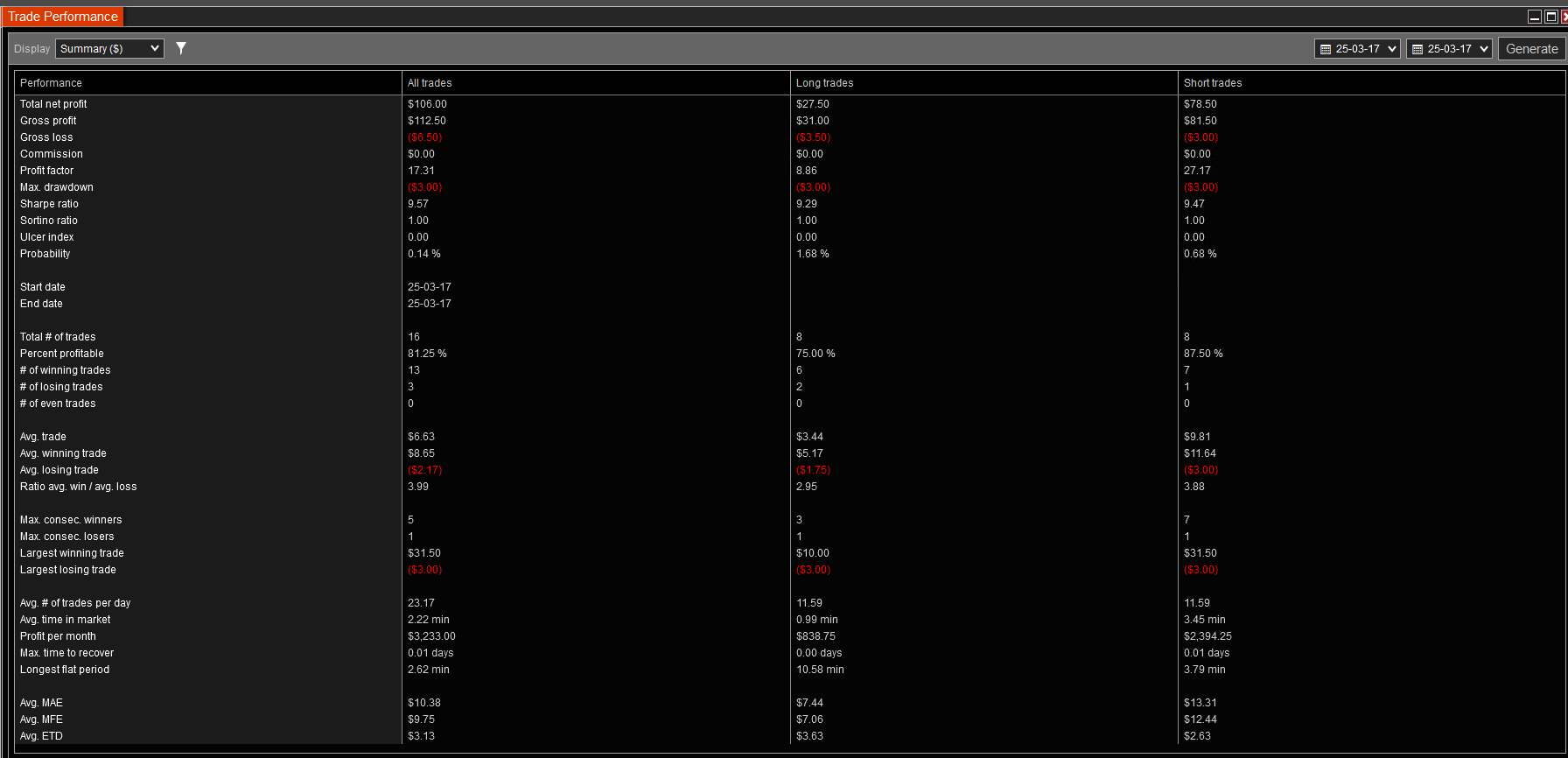

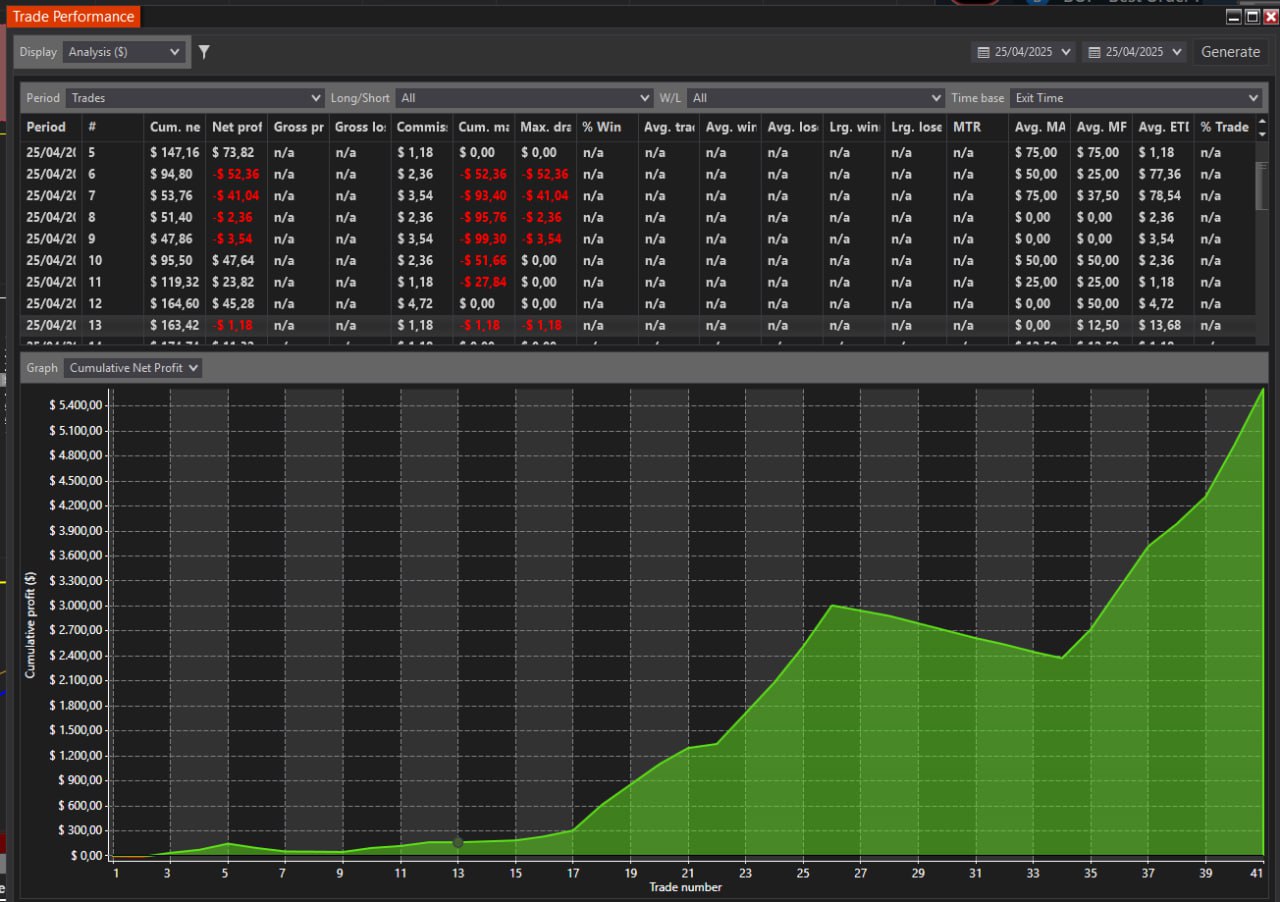

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.