BIG TRADES INDICATOR

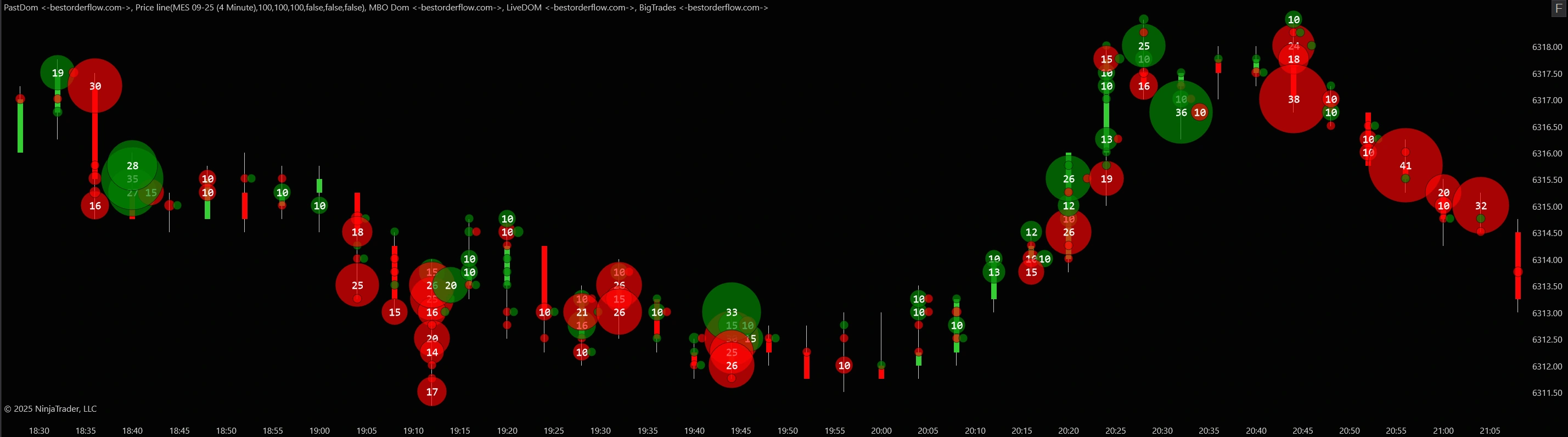

The Big Trades indicator is included in Pack 2 and works with level 1 data. Why is it included in Pack 2? This indicator enables the immediate visualization of interactions between orders at level 1 and orders at level 2.

The Big Trades indicator lets you hide insignificant or small-sized orders from the chart.

The "Big Trades" indicator for NinjaTrader is a tool designed to highlight significant market transactions, often referred to as "aggressive" or "large" trades, that occur on the order book. These trades are typically executed in large volumes at once and are visible in the Big Trades indicator, which is a part of Pack 2 on Bestorderflow.com.

The indicator visually represents large orders with circles or bubbles (bubbles are part of the LEDGER package) to make them easily identifiable on the price chart.

The Big Trades indicator aims to help traders quickly identify and assess the size of significant transactions in the market. The Big Trade indicator displays orders in real-time, allowing traders to stay informed about the latest significant trades as they occur.

The Big Trades indicator is often used in conjunction with other order flow analysis tools, such as the Heatmap indicator, particularly on smaller timeframes for scalping and day trading.

Big Trades is a must-have indicator and is widely used in almost any strategy, including price action, order flow, momentum scalping, pullbacks, and breakouts. The Big Trades indicator is a must-have for your trading arsenal.

VISUAL PRESENTATION LEVEL 2 INDICATORS

Watch the presentation about Indicators from Pack 2 on the main menu Level 2 https://bestorderflow.com/marketdepth

PACK 2 TRADING STRATEGIES:

Strategies based on Level 2 indicators that include Live Dom, Past Dom, delta 2, Pulling and Stacking, Big Trades

BIG TRADES VIDEO + PDF MANUAL

Manuals / Instructions / Explainer about how to set up Footprint:

1) Download Big Trades PDF Manual ![]()

AAAABig Trades - Institutional Trades Indicator Manual

Watch Big Trades explainer video:

LINKS FOR PACK 1 INDICATORS

(links open in a new window) :

- Footprint indicator for NinjaTrader (click to learn more): Bid/ Ask, Stack imbalances, Filtered imbalances, Clusters, Absorption, Diversions, Delta blocks, Delta visualization,

- Volume profile indicator for NinjaTrader (click to learn more) is a horizontal histogram that displays the volume spread across vertical price levels. It shows traders where the most activity occurs at specific price points. The volume profile provides insights into market liquidity and potential support and resistance levels. Link: Read all about the Volume profile

- Delta Profile for NinjaTrader

- Footer indicators for NinjaTrader (click to learn more): Volume indicator, indicator for Delta bid, and Ask,

- Market Speed indicator (speed of tape) for NinjaTrader for NinjaTrader,

- Absorption indicator on the Footprint indicator for NinjaTrader.

- UtilitiesUtilities for NinjaTrader (click to learn more): Trades visualization indicator, Chart Scroll advanced

- Templates for Pack 1 Indicators - Chart Templates and Indicator templates for the NinjaTrader platform included

PACK 2 INDICATORS LINKS

(links open in a new window) :

Links for Pack 2 indicators: Passive side of orderflow:

- Live DOM (click to learn more):

- Pulling and stacking in a Live Dom

- Total Pulling and Stacking on a live Dom,

- Past DOM (click to learn more):

- Two-color heatmap

- Delta for Pulling and Stacking (horizontal indicator above footer).

- Dom - vertical histogram for level 2 passive orders

- Big Trades (click to learn more)

Based on level 1 data, aggressive orders by market:

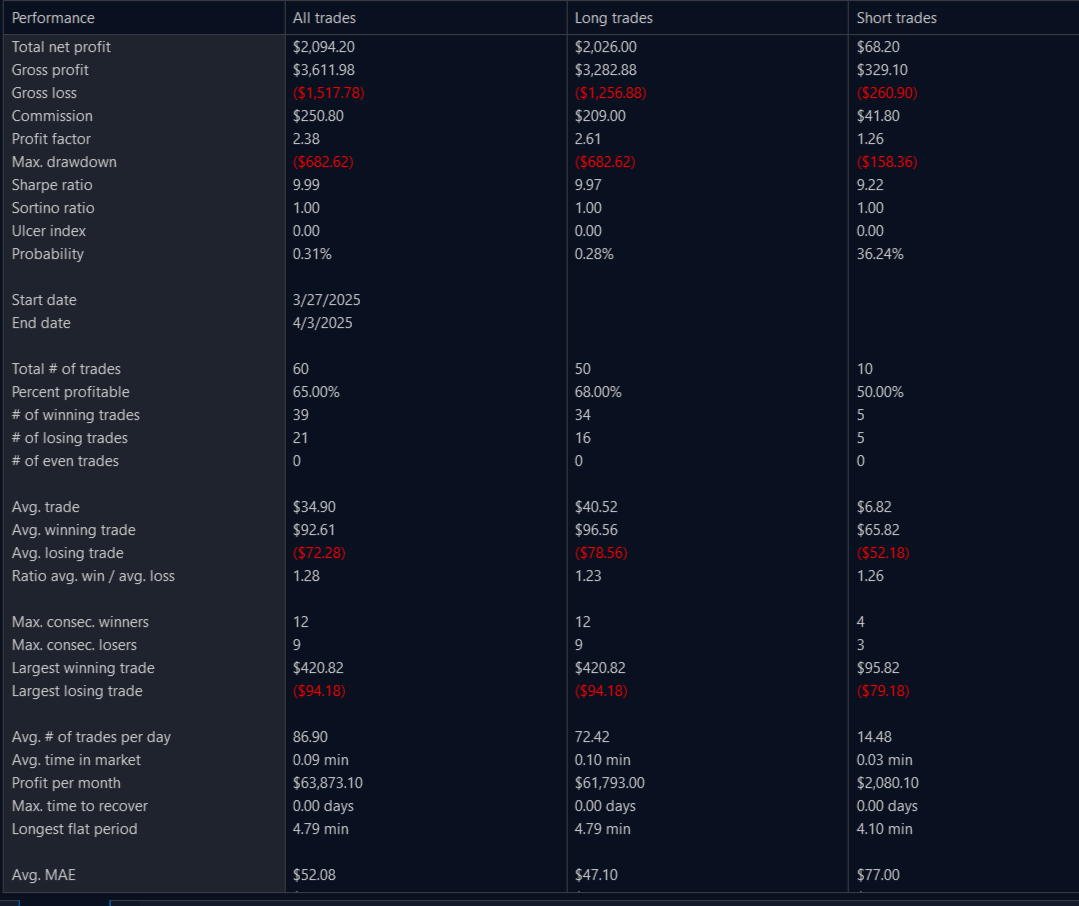

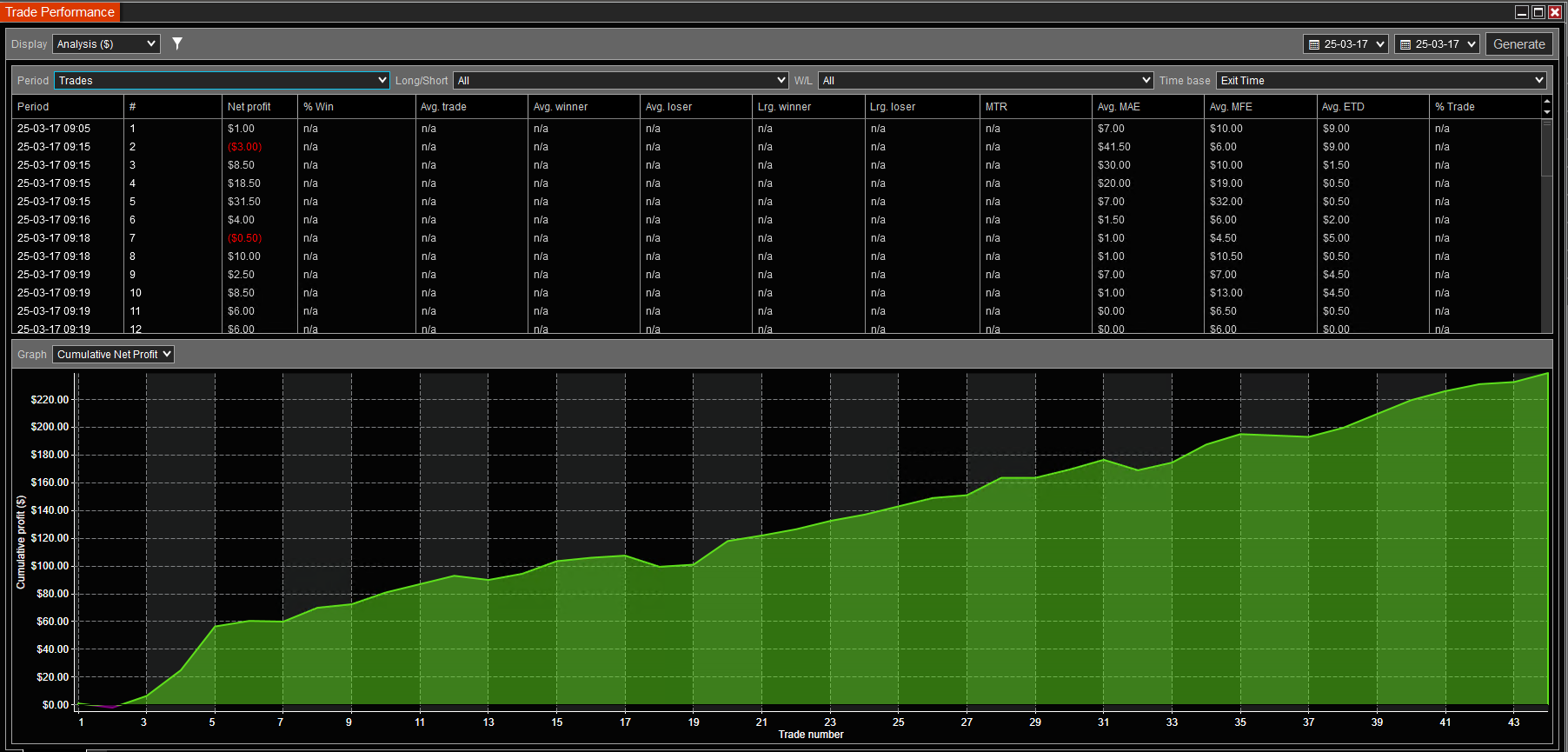

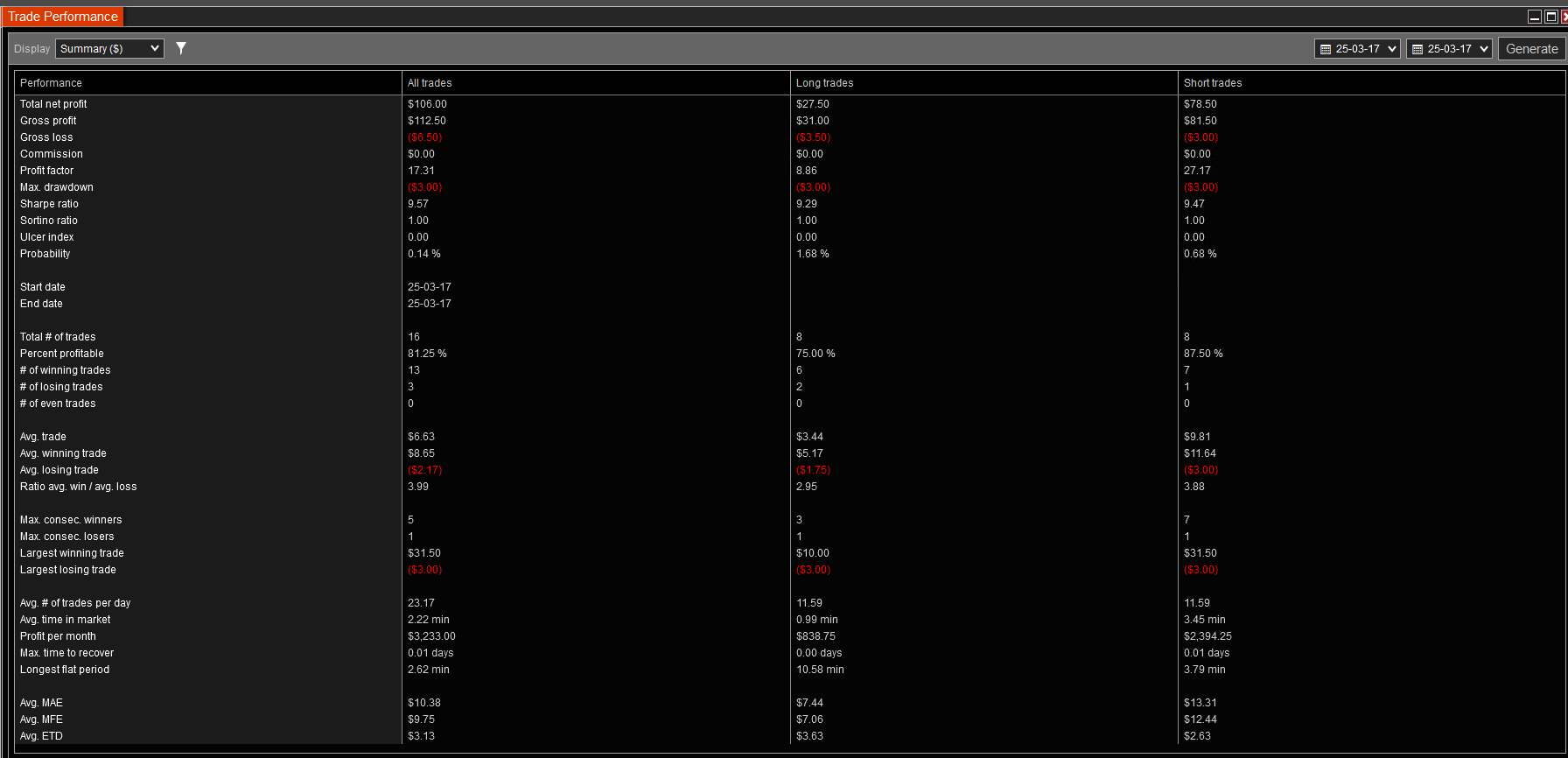

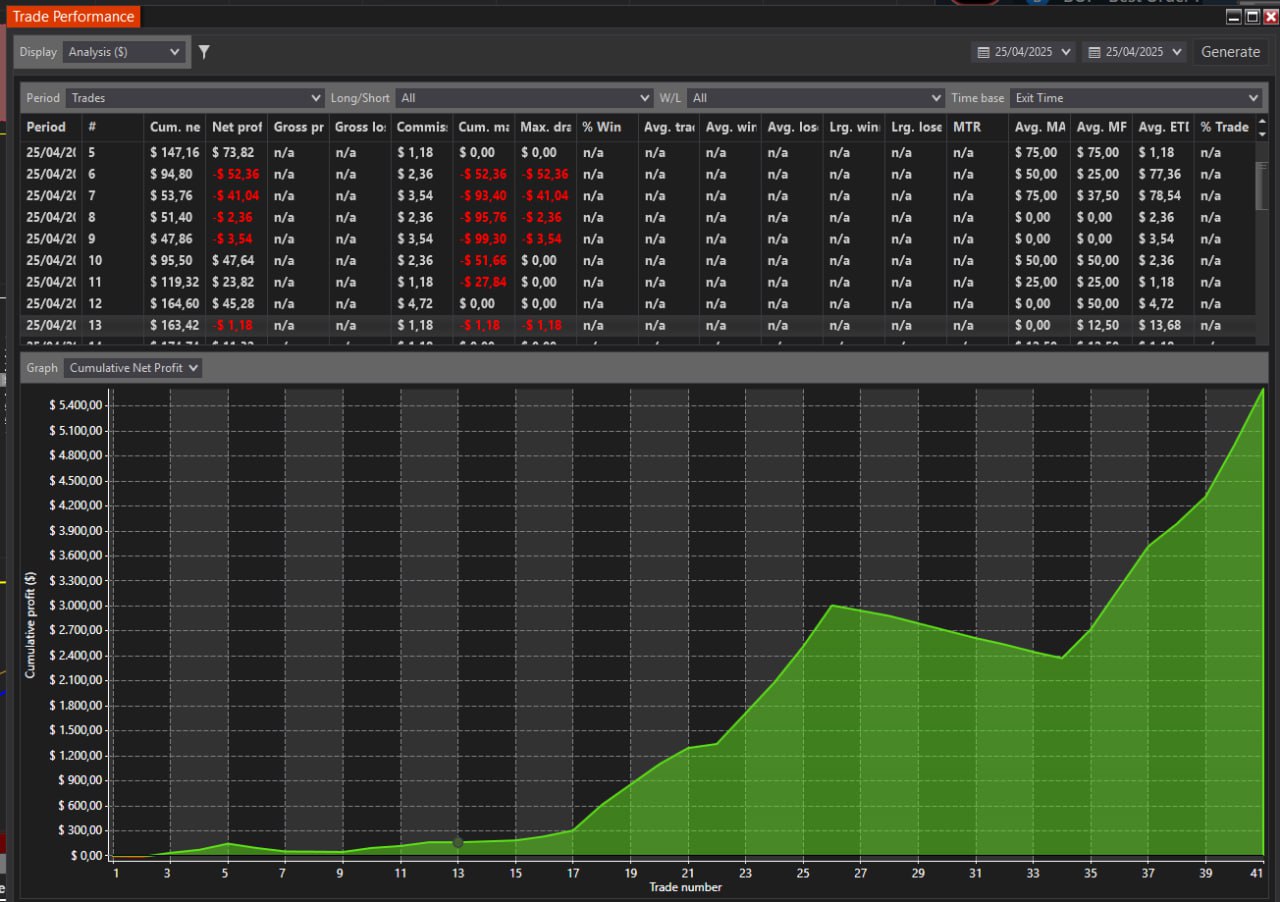

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.

I have passed one more funding account with Apex Trading today and made $3,000, which is the threshold for passing the account. I traded NQ, and the Bestorderflow indicators are excellent for passing props.